You won’t believe how much Ethereum Tom Lee’s Bitmine now holds

You won’t believe how much Ethereum Tom Lee’s Bitmine now holds

![]() Cryptocurrency Aug 27, 2025 Share

Cryptocurrency Aug 27, 2025 Share

Ethereum’s (ETH) climb past $4,600 has been met with a powerful show of confidence from one of Wall Street’s most outspoken crypto advocates.

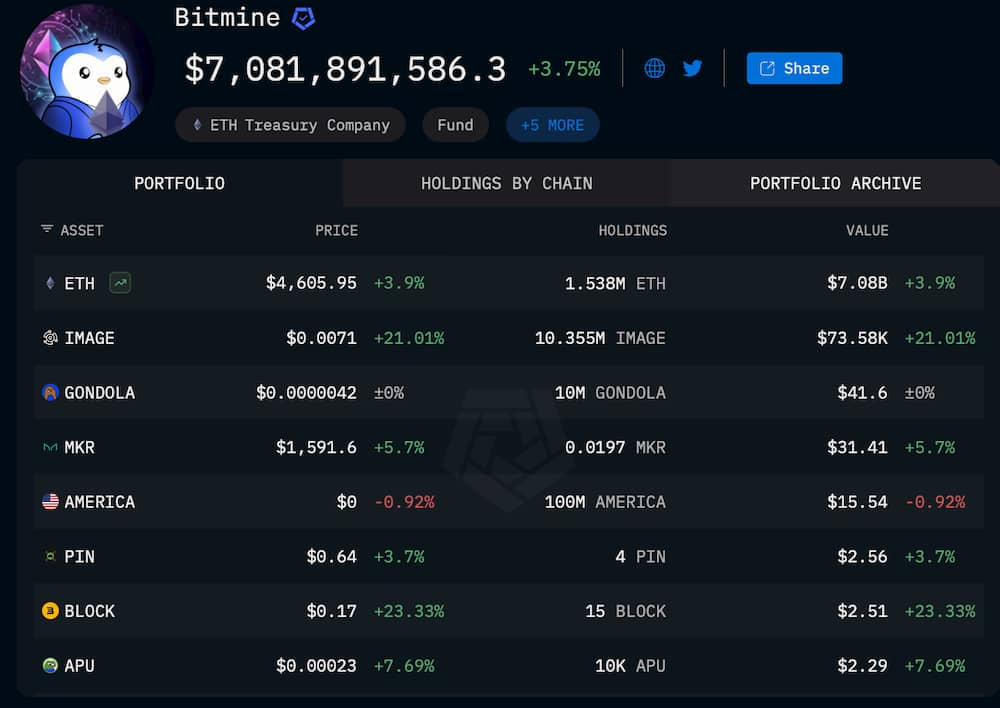

BitMine, linked to Fundstrat co-founder Tom Lee, now holds more than $7.08 billion worth of Ethereum, according to data from on-chain intelligence platform Arkham on Wednesday, August 27. The entity’s 1.538 million ETH makes it one of the single largest corporate treasuries in the crypto space.

In the last 24 hours, Bitmine added another $21.3 million in ETH, underscoring its aggressive accumulation strategy. Market trackers suggest the firm is aiming for control of 5% of Ethereum’s total circulating supply, $27 billion at current prices.

Ethereum holdings in Bitmine portfolio. Source: Arkham

Ethereum holdings in Bitmine portfolio. Source: Arkham

Rotation into Ethereum from Bitcoin

The scale of the bet reflects a broader capital rotation unfolding across digital assets. On Tuesday, analysts noted a significant shift from Bitcoin (BTC) into Ethereum, with futures activity, ETF flows, and whale positioning increasingly tilting toward the world’s second-largest cryptocurrency.

Capital has been rotating from BTC→ETH.

Flows into ETH, at 0.9B USD per day (silver), is now approaching BTC's inflows (orange).

This latest climb in flows started when Tom Lee's ETH treasury co, BitMine, started their ETH accumulation. pic.twitter.com/ZLTCSosxXX

— Willy Woo (@woonomic) August 26, 2025

Ethereum’s latest push coincides with record institutional inflows, an expanding DeFi ecosystem, and scaling breakthroughs on Layer 2 networks. With ETH ETFs attracting billions in assets under management since their debut earlier this year, Bitmine’s accumulation appears designed to front-run what it sees as Ethereum’s long-term dominance.

At press time, ETH traded at $4,605, up 3.9% on the day, outperforming both Bitcoin and most large-cap altcoins. If Bitmine’s trajectory continues, Ethereum’s supply dynamics could tighten considerably, creating the conditions for another leg higher in price.