Why Analysts Are Split on Bitcoin Miner MARA’s Prospects

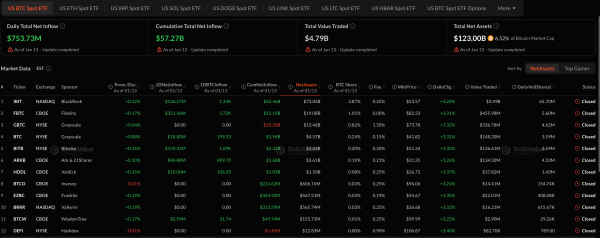

Two investment banks are split over how top American Bitcoin miner MARA Holdings will perform, with JPMorgan slashing its most recent price target but Compass Point analysts upgrading its rating in separate notes on Monday.

The JPMorgan analysts cut their December 26 price target for the top Nasdaq-listed miner from $20 to $13, noting that the dramatic fall of Bitcoin’s price had reduced the value of the company’s massive BTC holdings, while Compass Point highlighted the company’s solid fundamentals.

The differing views came as Bitcoin miners have been hard-hit in recent weeks, along with other crypto-focused stocks that have been stung by a dramatic downturn in crypto markets. MARA shares, inched up over $10 per share Monday morning, but have nosedived by about 43% over the past month, according to Yahoo Finance data.

Bitcoin was recently trading at $88,417, up 1.6% over the past 24 hours but down by nearly 5% over the past seven days, according to crypto markets data provider CoinGecko. The largest digital asset by market value is down nearly 30% since hitting an all-time high of $126,088 in early October.

Miami-based MARA is the second largest publicly traded crypto treasury, with 53,250 BTC worth $4.6 billion at today’s prices.

But Compass Point researchers said in a Monday note that the firm’s foundation was more important—and they updated MARA’s rating while maintaining a $30 price target.

“We upgrade MARA to Buy from Neutral as we believe the sell-off related to Bitcoin’s retrace has overshot fundamentals,” the analysts wrote.

“On a Bitcoin mining basis alone, we view MARA as undervalued as the company continues to grow and leverage partnerships and cheaper power,” they continued, adding that the firm’s “nascent AI business” being “pure upside.”

“We view MARA as a differentiated stock in the AI sector for investors with concerns over capex cycles and long-term viability,” the analysts said.

JP Morgan analysts were bullish on other miners, though, giving Cipher a price target of $18 from $12 and CleanSpark an “overweight” rating. They also raised IREN’s target to $39 from $28. CleanSpark shares have plummeted about 35% over the past month, while Cipher and IREN are off more than 20%.

In a Myriad prediction market, two in three respondents expect Bitcoin to rise to $100,000 with the remaining believing its next big move will be down to $69,000. Myriad is a unit of Dastan, the parent of an editorially independent Decrypt.