This statistic hints at extended Bitcoin losses in the next 7 days

This statistic hints at extended Bitcoin losses in the next 7 days

![]() Cryptocurrency Aug 25, 2025 Share

Cryptocurrency Aug 25, 2025 Share

As Bitcoin (BTC) faces the renewed threat of plunging below the $110,000 support amid a broader market sell-off, historical data suggests the asset may be destined for more losses in September.

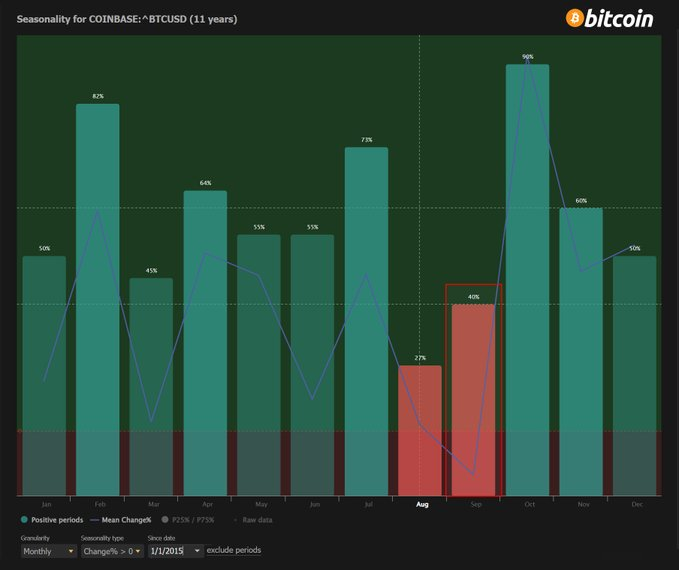

Since 2015, Bitcoin has managed only a 40% win rate in September, with an average return of -2.5%, according to data from charting platform TrendSpider shared on August 25.

Bitcoin seasonality chart. Source: TrendSpider

Bitcoin seasonality chart. Source: TrendSpider

The seasonality outlook points to a bearish trend, placing September alongside August as one of the least favorable months for BTC holders.

In contrast, months such as February and October have delivered outsized gains, boasting win rates of 82% and 90% respectively.

BTC’s new bearish sentiment

Notably, the statistic emerges at a time when Bitcoin is grappling with fresh bearish sentiment, as whale selling and exchange-traded fund outflows weigh on investors’ confidence. To this end, analysts have laid out several scenarios for the flagship cryptocurrency.

In this line, according to pseudonymous cryptocurrency analyst BitBull, Bitcoin has once again rebounded from its 50-day Exponential Moving Average (EMA), a level that has served as a reliable support throughout the current bull cycle.

Bitcoin price analysis chart. Source: BitBull

Bitcoin price analysis chart. Source: BitBull

However, the analyst cautioned that the bottom may not yet be in. Historically, Bitcoin has dipped below the 50-EMA, triggering capitulation and shaking out overleveraged traders before resuming its uptrend.

Based on this pattern, a potential move toward the $106,000 to $108,000 range remains possible. While painful in the short term, such a retracement could act as a final bear trap before Bitcoin begins its next leg higher, according to BitBull.

Bitcoin price analysis

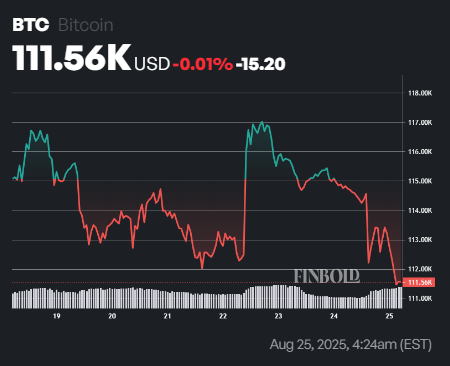

By press time, Bitcoin was trading at $111,555, down nearly 2.7% in the last 24 hours.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

At the current price level, attention now shifts to BTC’s immediate support at $110,000. Losing this position could trigger a deeper correction, possibly dragging the asset below the $100,000 mark.

Featured image via Shutterstock