This R. Kiyosaki anti-stock strategy has delivered monster returns, knocks out S&P 500

This R. Kiyosaki anti-stock strategy has delivered monster returns, knocks out S&P 500

![]() Cryptocurrency Sep 13, 2025 Share

Cryptocurrency Sep 13, 2025 Share

Robert Kiyosaki, the bestselling author of ‘Rich Dad Poor Dad’, has long been vocal about favoring alternative assets such as gold, silver, and Bitcoin (BTC) over traditional equities.

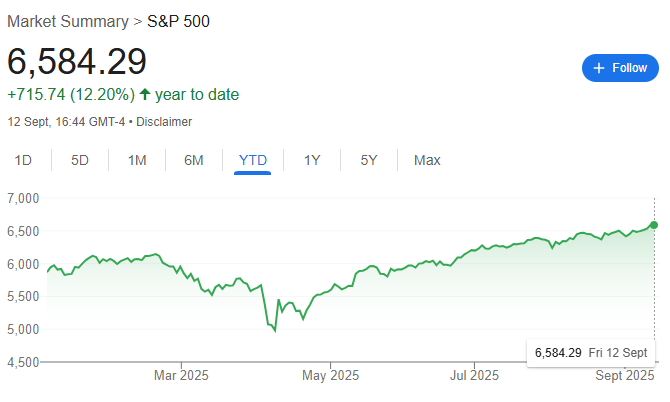

Now, in 2025, his approach appears to be paying off, with his preferred investments delivering returns that far outstrip the benchmark S&P 500.

Among the assets, Bitcoin, one of Kiyosaki’s recommended hedges against inflation, began the year trading at $93,510 and now sits at $116,111, marking a 24% gain. Kiyosaki has reiterated that he continues to buy Bitcoin, maintaining his belief that the cryptocurrency has the potential to reach $1 million per coin.

BTC YTD price chart. Source: Finbold

BTC YTD price chart. Source: Finbold

The author has also recommended investing in Solana (SOL), which has delivered solid returns in 2025. SOL rose from $189 to $242, a 28% increase.

SOL YTD price chart. Source: Finbold

SOL YTD price chart. Source: Finbold

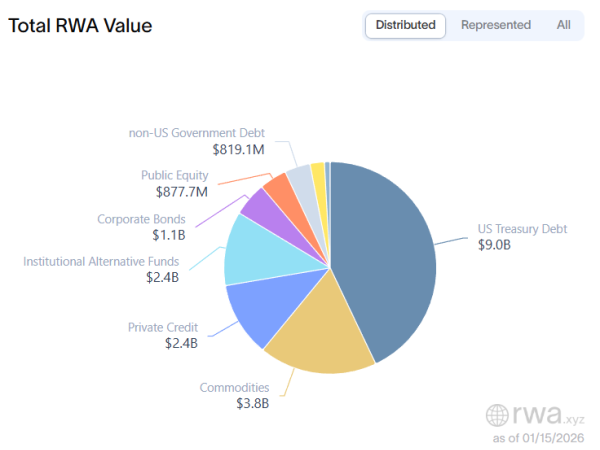

Among his preferred assets, precious metals have been standout performers across the year. These commodities have attracted strong investor interest as markets search for hedges during a period of heightened uncertainty.

To this end, gold climbed from $2,658 to $3,643, a surge of 38.8%, while silver jumped from $29 to $42, an impressive 44% year-to-date rally.

Taken together, these four core assets have delivered an average return of 33.7% in 2025, nearly triple the performance of the S&P 500, which has advanced 12% year-to-date, from 5,868 to 6,584.

S&P 500 YTD chart. Source: Google Finance

S&P 500 YTD chart. Source: Google Finance

Kiyosaki’s other investments

It’s worth noting that Kiyosaki’s portfolio extends beyond digital assets and precious metals. For decades, real estate has been a cornerstone of his wealth-building strategy.

Looking ahead, Kiyosaki maintains his bearish stance on fiat currencies and U.S. equities, often warning of potential financial instability.

He has stressed that Bitcoin, gold, and silver remain the ideal assets to protect wealth in the event of a crash, which he continues to project is on the horizon.

Featured image via Ben Shapiro’s YouTube