Simon Gerovich Highlights Japan Surge in Corporate Bitcoin Holdings

Simon Gerovich, CEO of Metaplanet, shared new data showing Japan’s rapid rise in corporate Bitcoin adoption. He pointed to the 2026 Annual Report from Bitcoin For Corporations, which tracks how public companies use Bitcoin as a treasury asset.

米国を除くと、日本は企業によるビットコイン保有の伸びが最も大きい国です。全文レポートはこちら:https://t.co/arnzfwBf2n https://t.co/gS9NqL4lqR pic.twitter.com/GxaFTYMr7s

— Simon Gerovich (@gerovich) January 24, 2026

The report shows that, outside the United States, Japan now records the largest increase in corporate Bitcoin holdings. In fact, Japan accounts for about half of all non-US corporate Bitcoin on balance sheets. This marks a major shift in how Asian firms view digital assets. The update signals a growing trend. More companies are moving beyond speculation and treating Bitcoin as part of a long term capital strategy.

Metaplanet drives Japan’s momentum

Metaplanet stands at the center of this change. The Tokyo-listed firm was one of the first in Japan to adopt Bitcoin at scale. It openly modeled its strategy on US based corporate treasuries. As of late 2025, Metaplanet held 35,102 BTC. The company built this position over time and made several large purchases in the past year. In the fourth quarter of 2025 alone, it added over 4,200 BTC.

Simon Gerovich often says Metaplanet’s goal is simple. Protect value and build long term capital using BTC instead of weakening fiat currency. Because of this visible strategy, other Japanese firms have started to explore similar paths. Gerovich has said that many local companies now ask how Bitcoin treasuries work and how they can begin. Indeed, in Japan, Metaplanet became a reference point after it showed that holding Bitcoin is not just for tech firms. Consequently, traditional companies realize they can do it too.

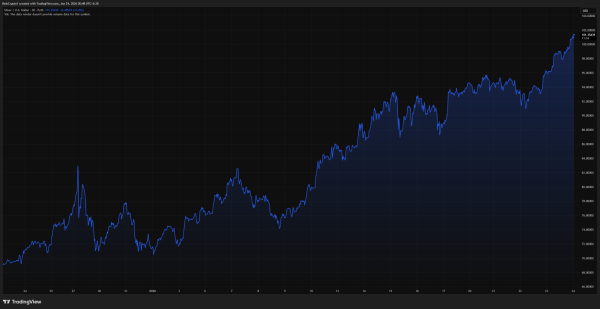

Holdings jump from near zero to tens of thousands

The report highlights how fast the change has been. In late 2024, Japanese corporate Bitcoin holdings were close to zero. By early 2026, they reached tens of thousands of BTC. This rise places Japan at the top among non-US countries. China remains close but Japan now matches or exceeds it in growth speed. Several factors help explain the trend. The weak yen makes dollar priced assets like BTC more attractive. At the same time, Japan’s regulatory environment has become clearer and more supportive of digital assets.

Companies also face pressure to protect reserves. With inflation concerns and low real yields, Bitcoin offers an alternative store of value. The report groups firms into tiers. The largest holders sit in a small top tier. Meanwhile, a fast growing “long tail” includes smaller firms like Metaplanet and Semler Scientific. Together they show that BTC on balance sheets is becoming more normal.

Community reaction and global context

Simon Gerovich’s post drew praise from supporters who credit Metaplanet for leading the shift. Specifically, many said the company helped educate Japanese firms and prove that Bitcoin strategies can work in public markets. Globally, the report shows that some corporate Bitcoin strategies scale well while others fail. The key difference is discipline. Firms that buy with long term intent tend to perform better than those that chase hype. Outside the US, Japan now sets the pace. It shows how Bitcoin adoption can spread when one firm proves the model.

Japan’s growing role in corporate Bitcoin

Japan’s rise marks a turning point. It is no longer just a follower of US trends. It is now shaping corporate Bitcoin use in its own region. If this path continues, more Asian firms may adopt similar strategies. Weak fiat currencies and changing treasury models could push them further. For now, the message from Simon Gerovich is clear: Japan is no longer watching from the sidelines. It is becoming a leader in corporate Bitcoin adoption.