Polymarket predicts XRP price for January 31

Polymarket predicts XRP price for January 31

![]() Cryptocurrency Jan 9, 2026 Share

Cryptocurrency Jan 9, 2026 Share

One of Polymarket’s most popular trades has become betting on the future of cryptocurrency markets, with XRP’s likely price at the end of January 2026 proving a hot topic.

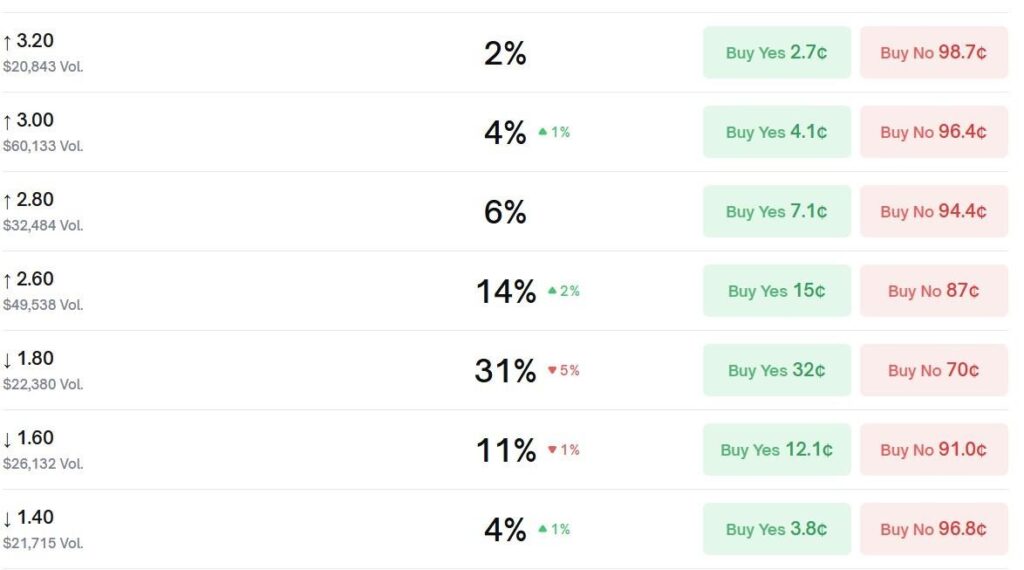

According to the Polymarket community, the fourth-largest digital asset by market capitalization is most likely to retrace 14.69% from its press time price of $2.11 to $1.80.

In fact, despite XRP’s 12.47% rally since New Year’s Day, the prediction market is estimating a 31% chance it will fall to the lower price level. The second most likely outcome for the month – a 23.22% rally to $2.60 – has a 14% chance of being met.

The other probable outcomes, per the odds on Polymarket, are $1.60 at 11%, $2.80 at 6%, $3, and $1.40 – both at 4% – and $3.20 at 2%. All other possible price levels are estimated either at 1% or at a lower than 1% chance.

XPR January 31 price odds spread. Source: Polymarket

XPR January 31 price odds spread. Source: Polymarket

Why XRP might rally by January 31

The relative bearishness appears at odds with XRP’s recent performance. While it is true that the token retraced 11.72% from its 2026 high of $2.39, it is 12.47% up in the year-to-date (YTD) chart.

XRP YTD price chart. Source: Finbold

XRP YTD price chart. Source: Finbold

Likewise, though the correlation between Ripple Labs’ success and the cryptocurrency’s strength isn’t perfect, it is noteworthy that Director Monica Long recently highlighted that her company is in a sufficiently good place that it simply does not need additional funds that could potentially be raised through an initial public offering (IPO).

The bear case for XRP in January 2026

Still, some explanation for the apparent pessimism could be found both by zooming in and zooming out on the price performance. Along with dropping 11.72% from its 2026 high, XRP is 25.71% down in the last six months, due to a wider cryptocurrency market downturn of late 2025.

Similarly, despite January 8 featuring approximately $4 million in spot XRP exchange-traded fund (ETF) inflows, January 7 was a market shock as it was the first day of outflows in 55 days – a streak that has been unbroken since the November 13, 2025, launch.

Featured image via Shutterstock