Over $130 billion flows into crypto market in 24 hours

Over $130 billion flows into crypto market in 24 hours

![]() Cryptocurrency Jan 14, 2026 Share

Cryptocurrency Jan 14, 2026 Share

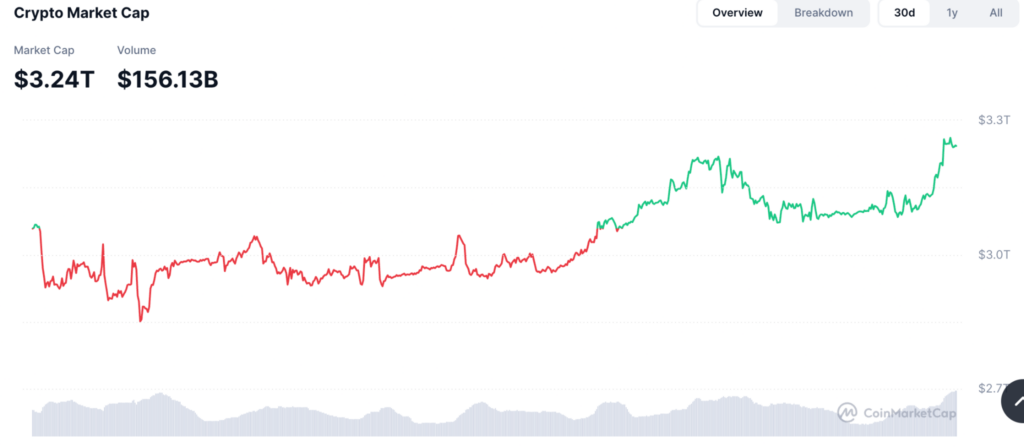

The cryptocurrency market added more than $130 billion in value over the past 24 hours, reflecting a renewed inflow of capital into digital assets.

As of press time, total crypto market capitalization stood at $3.24 trillion, up from $3.11 trillion a day earlier, a net increase of roughly $130 billion.

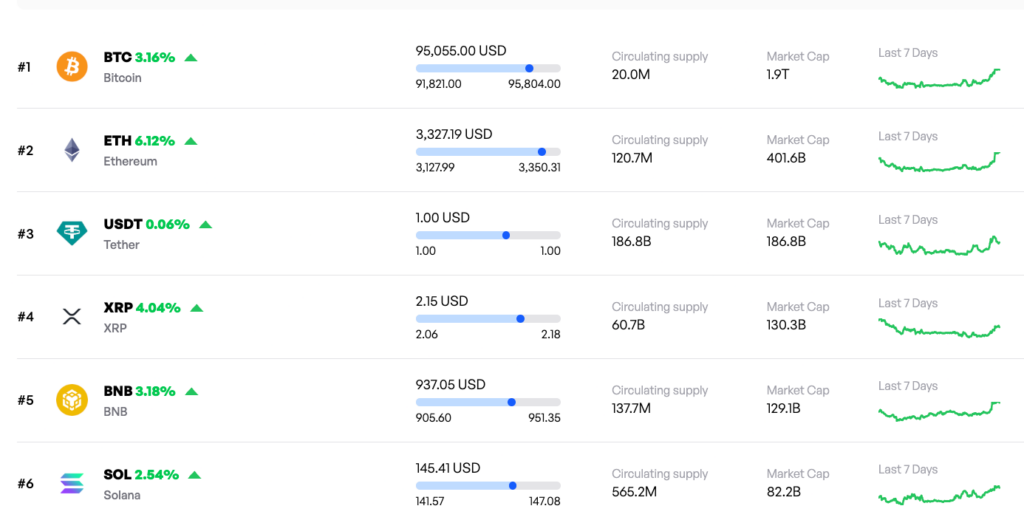

The rally was led by Bitcoin (BTC), which traded at $95,055 after ranging between $91,821 and $95,804 during the session. Bitcoin’s market capitalization rose to about $1.9 trillion, making it the largest contributor to the broader market move. Ethereum (ETH) followed with solid gains, trading at $3,327.

Total crypto market cap chart. Source: CoinMarketCap

Total crypto market cap chart. Source: CoinMarketCap

Other major cryptocurrencies also advanced, with XRP rising to $2.15, trading between $2.06 and $2.18, lifting its market capitalization to around $130.3 billion. BNB climbed to $937.05, with intraday prices between $905.60 and $951.35, pushing its market value to roughly $129.1 billion. Solana (SOL) traded at $145.41, fluctuating between $141.57 and $147.08, and saw its market cap increase to about $82.2 billion.

Top cryptocurrency performances. Source: Finbold

Top cryptocurrency performances. Source: Finbold

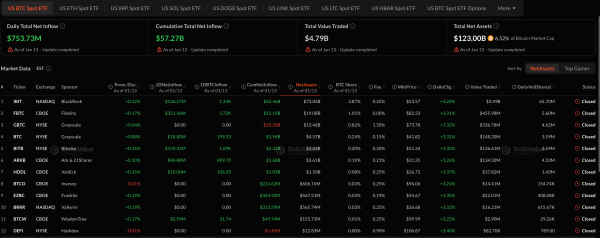

Why crypto market is rising

Institutional demand was a key driver of the move. In this case, U.S. spot Bitcoin exchange-traded funds (ETFs) recorded $753.7 million in net inflows in a single day, their largest daily total in three months, pointing to renewed allocations after a subdued end to 2025 marked by tax-driven selling and risk-off positioning.

Bitcoin also gained support after Strategy disclosed a $1.25 billion purchase of 13,627 BTC at an average price of $91,519. The acquisition raised Strategy’s total Bitcoin holdings to 687,410 BTC, reinforcing its position as the largest corporate holder and easing concerns that its accumulation pace had slowed.

Despite the strong headline gains, demand signals were mixed. Bitcoin continued to trade at a discount on Coinbase relative to offshore exchanges such as Binance, resulting in a negative Coinbase Premium and indicating softer buying pressure from U.S.-based investors compared with global demand.

Meanwhile, recent U.S. inflation data showed further cooling, reinforcing expectations that the Federal Reserve could pivot toward interest rate cuts later this year, a backdrop that has historically supported risk assets.

Featured image via Shutterstock