Goldman Sachs just updated it’s crypto portfolio

Goldman Sachs just updated it’s crypto portfolio

![]() Cryptocurrency Feb 11, 2026 Share

Cryptocurrency Feb 11, 2026 Share

American banking giant Goldman Sachs has disclosed substantial exposure to the cryptocurrency market, with its latest filing indicating holdings worth over $2 billion.

Specifically, the Wall Street titan reported $2.36 billion in crypto-linked investments in its latest Form 13F filing for the fourth quarter of 2025, representing about 0.33% of its total equity portfolio.

The holdings, reported as of December 31, 2025, are entirely through regulated spot exchange-traded funds (ETFs) rather than direct ownership of digital assets.

Bitcoin (BTC) and Ethereum (ETH) make up the bulk of the allocation. Bitcoin-focused ETFs account for about $1.1 billion, largely through BlackRock’s iShares Bitcoin Trust, with additional exposure via other issuers. Ethereum ETFs represent approximately $1.0 billion.

The filing also shows smaller allocations to alternative cryptocurrencies, with XRP-related ETFs totaling around $153 million, while Solana (SOL)-linked funds account for roughly $108 million.

Goldman Sachs portfolio hit with volatility

It is worth noting that since the end of the reporting period, market volatility has likely reduced the portfolio’s value.

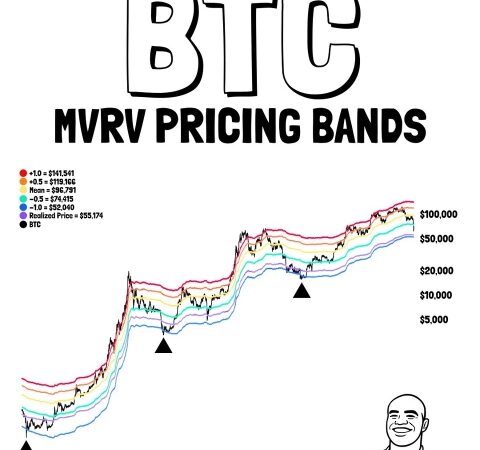

A pullback in Bitcoin prices shortly after year-end would have weighed on the bank’s indirect exposure, considering the leading digital currency lost the $90,000 support at one point, plunging as low as $61,000.

By using ETFs, the bank avoids the operational demands of direct crypto custody, including infrastructure, security, and compliance requirements. ETF exposure allows positions to be managed within existing trading and risk systems.

However, spot crypto ETFs charge management fees that can amount to millions of dollars annually on a multibillion-dollar allocation.

In addition, ETF shares may not perfectly track underlying asset prices during periods of volatility.

Indirect investors also miss out on staking rewards and other blockchain-based incentives available to direct token holders.

Featured image via Shutterstock