French Chipmaker Sequans Plans $200 Million Share Sale to Build Bitcoin Treasury

Sequans Communications (NYSE: SQNS), a Paris-based semiconductor firm listed on the New York Stock Exchange, has filed to raise up to $200 million through an at-the-market equity program, with proceeds directed primarily toward Bitcoin purchases under its long-term treasury strategy.

The new program supports the first phase of Sequan’s efforts at establishing its treasury foundation. Sequans intends “to use it judiciously to optimize treasury,” CEO Dr. Georges Karam said in a statement on Tuesday.

Its latest SEC filing enables the company to issue American Depositary Shares at its discretion. ADSs are certificates that allow U.S. investors to trade shares of foreign companies on American exchanges.

In July, Sequans also raised $189 million through secured convertible debentures and warrants, bringing total recent financing to roughly $376 million.

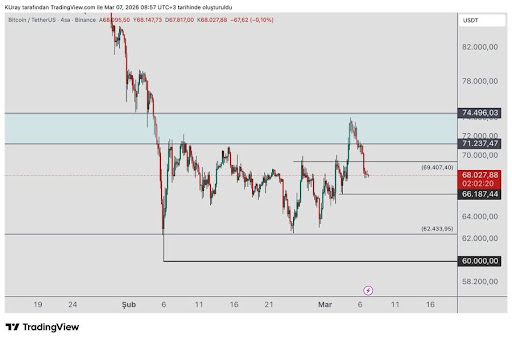

So far, Sequans already holds more than 3,000 Bitcoin, worth about $331 million at current prices, making it one of the largest corporate holders of Bitcoin in Europe, behind only Germany’s Bitcoin Group SE. It has also set an ambitious target of 100,000 by 2030.

‘Scalable if tailored’

Raising equity to buy Bitcoin “certainly dilutes existing shareholders, and it ties the company’s valuation more directly to Bitcoin’s volatility,” Dan Dadybayo, research and strategy lead at Unstoppable Wallet, told Decrypt.

But these prospects largely depend on execution, he argues.

“Equity-funded BTC purchases act less like speculative punts and more like leveraged exposure: shareholders accept dilution in exchange for long-term alignment with Bitcoin’s growth,” he said.

Still, “smaller firms can innovate using structured financing, options strategies, or BTC-backed deals to accumulate effectively. The model is not copy-paste, but scalable if tailored,” Dadybayo said.

Dadybayo adds the risk isn’t with short-term price swings, but on “whether the company can maintain operational discipline and avoid overextension during downturns.”

While Sequans can “accumulate BTC at scale relative to its size,” he notes that it lacks “the financial cushion to absorb prolonged drawdowns without shareholder pain.”