Ethereum outpaces crypto market with 41% monthly surge; Bitcoin at $119K. Should you buy?

Synopsis

Ethereum has significantly outperformed the broader crypto market, surging 41% in the past month, driven by strong ETF inflows and positive sentiment. Bitcoin has shown resilience, rebounding to a 10-day high of $119,000 amid geopolitical tensions. Experts suggest potential pullbacks for Ethereum if it fails to surpass $4,350, while Bitcoin eyes resistance between $117,335 and $123,250.

Ethereum has surged nearly 41% in the past month, outpacing the 9% rise in the total crypto market cap. Over the past three months, it has gained 59.30% and is up 14% in the last week.

“Ether has surged 41% in the past month, far outpacing the 9% rise in the total crypto market cap. This strong outperformance has driven higher hedging demand as traders secure profits and diversify into other assets,” said Harish Vatnani, Head of Trade, ZebPay.

“Caution above $4,000 is evident, with limited appetite for leveraged bullish bets despite $683 million in net inflows into spot ETH ETFs over just two days. Still, neutral derivatives readings suggest resilience, especially after the rapid rally from $3,400 to $4,300 in only eight days,” Vatnani added.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker19.59% BuySmart Contract Tracker18.28% BuyBTC 50 :: ETH 5014.90% BuyNFT & Metaverse Tracker9.46% BuyWeb3 Tracker9.35% BuyTOP COINS (₹) Ethereum405,526 (7.74%)BuyBNB73,223 (3.42%)BuyXRP283 (2.51%)BuyBitcoin10,469,749 (0.48%)BuyTether88 (0.06%)BuyHe further noted that “risk factors include potential pullbacks if ETH fails to clear $4,350 decisively. A rejection at current levels could lead to a retest of $4,150 support, while a break below $4,000 would signal a more significant correction toward the $3,800 zone.”

TOP COIN SETSDeFi Tracker19.59% BuySmart Contract Tracker18.28% BuyBTC 50 :: ETH 5014.90% BuyNFT & Metaverse Tracker9.46% BuyWeb3 Tracker9.35% BuyTOP COINS (₹) Ethereum405,526 (7.74%)BuyBNB73,223 (3.42%)BuyXRP283 (2.51%)BuyBitcoin10,469,749 (0.48%)BuyTether88 (0.06%)BuyHe further noted that “risk factors include potential pullbacks if ETH fails to clear $4,350 decisively. A rejection at current levels could lead to a retest of $4,150 support, while a break below $4,000 would signal a more significant correction toward the $3,800 zone.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Another expert, Vikram Subburaj, CEO, Giottus.com, said Ethereum (ETH) surged to fresh multi-year highs, climbing 8% to $4,620, fuelled by BitMine’s plan to raise an additional $20 billion for ETH purchases. Ethereum continues to lead on strong fundamentals, with $1 billion in net inflows into spot ETFs yesterday, and is targeting $5,000 by the end of August. The broad setup suggests the altcoin rally remains intact as long as Bitcoin avoids a decisive break below $116,000.

Live Events

Bitcoin

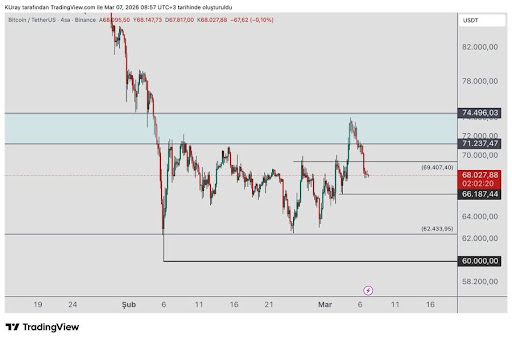

Bitcoin’s price was recorded at $119,000 in Tuesday’s trade, marking a resurgence to a 10-day high and topping out near $118,500—a testament to the market’s resilience amid broader geopolitical tensions.

“Bitcoin’s resurgence to a 10-day high, topping out near $118,500, is a testament to the market’s resilience amid broader geopolitical tensions, while Chainlink’s near 7% surge past $22 underscores the growing appetite for alpha-seeking altcoins. This kind of synchronized strength across major assets reflects not just speculative momentum but improving institutional confidence and capital flow in crypto markets,” said Avinash Shekhar, Co-Founder & CEO, Pi42.

As of 11:07 am IST, the world’s largest cryptocurrency was up 0.69% over the past 24 hours at $119,338, and has gained 4.41% over the last seven days.

What experts say

Parth Srivastava, Head of Quant, 9Point Capital’s Research Team:

Bitcoin’s structure remains bullish as sustained ETF inflows, led by BlackRock’s IBIT, continue absorbing supply at a rapid pace. With consistent 2,000–3,000 BTC daily accumulation and occasional large spikes, dips are being quickly bought. Momentum and on-chain trends suggest further upside potential as long-term holders remain steady and institutional demand stays robust.

CoinSwitch Markets Desk:

Bitcoin rebounded from early lows to test resistance above $120,000 but faced repeated rejections. After choppy consolidation, selling pressure pulled it back near $119,200, with a mild late recovery keeping momentum neutral to slightly bearish. ETH is trading near $4,620, its highest level since the all-time high of $4,800 in November 2021. The ETH ETF recorded inflows of just over $1 billion on August 11, followed by an additional $205 million yesterday.

Two publicly listed companies—Japan’s Metaplanet and the UK’s The Smarter Web Company—have added nearly $100 million worth of Bitcoin to their corporate treasuries. Meanwhile, Circle, the issuer of the USDC stablecoin, announced plans to launch an EVM-compatible layer-1 blockchain later this year.

Sathvik Vishwanath, Co-Founder & CEO, Unocoin:

Weak jobs data and payroll revisions have bolstered expectations for a September Fed rate cut, with rates steady at 4.25%–4.50% for five meetings. Data quality concerns are growing as the BLS halts CPI collection in some cities, raising imputation to 35% in June; Trump’s removal of BLS chief Erika McEntarfer adds political weight. Bitcoin is eyeing resistance between $117,335 and $123,250, supported by an ascending trendline and the 50-day SMA at $114,396. A breakout above $123,250 could target $127,000–$130,000, while a breakdown risks $113,650–$110,675. The RSI at 61 suggests more upside, but repeated $120,000 rejections indicate seller strength. Traders should wait for confirmation.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)