Did Bitcoin Just Bottom Out? What the Data Says About a Rebound

Bitcoin has spent several days under heavy selling pressure, dropping to the $85,000 zone before attempting a modest recovery. The drawdown has shaken market confidence, but the intensity of capitulation now emerging from Bitcoin holders suggests the market may be forming a bottom.

The price is stabilizing around a key psychological level, but this stabilization comes at the cost of widespread holder surrender — a classic bottoming signal.

Bitcoin Traders And Investors Let Go

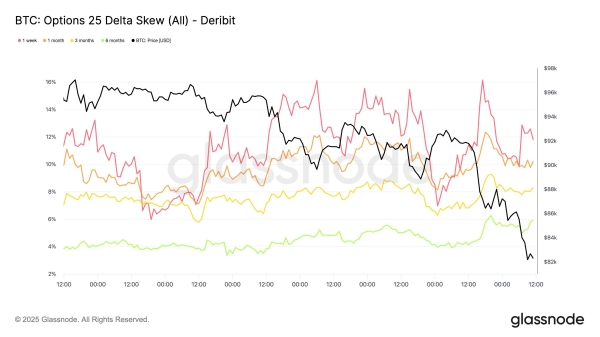

Macro momentum indicators show Bitcoin market’s risk expectations shifting aggressively. The 25-delta skew has pushed deeper into put territory across all maturities, signaling that traders are increasingly paying up for downside protection. Short-dated options remain the most skewed, but the notable shift is in longer expiries.

Six-month puts have gained two volatility points in just a week, highlighting a move toward structurally bearish positioning. Traders are now pricing both immediate downside risk and the possibility of a larger break.

This pattern typically appears near major cyclical bottom zones as markets overshoot to the downside before equilibrium returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Options 25D Skew. Source: Glassnode

Bitcoin Options 25D Skew. Source: Glassnode

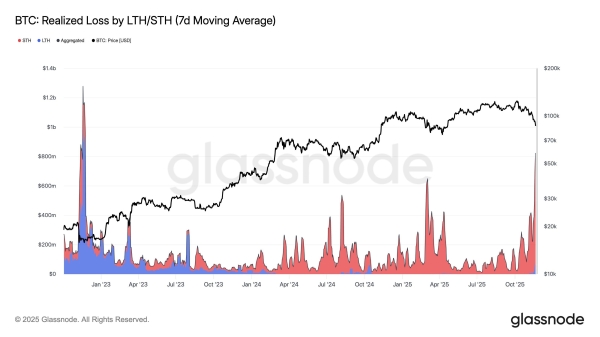

Realized losses among Bitcoin holders have surged to levels not seen since the FTX collapse. Short-term holders are driving most of this capitulation, reflecting panic selling from recent buyers who accumulated near the highs. The scale and speed of these realized losses indicate that marginal demand has been fully exhausted.

This type of aggressive deleveraging historically marks the final phase of a downturn. When short-term holders unwind en masse, long-term holders typically step in, and accumulation zones begin to form.

This aligns with classic bottoming behavior, where capitulation precedes recovery.

Bitcoin Realized Loss. Source: Glassnode

Bitcoin Realized Loss. Source: Glassnode

BTC Price Can Bounce Back

Bitcoin trades at $85,979 at the time of writing, holding above the $85,204 support level and defending the $85,000 psychological floor. The confluence of capitulation, bearish skew, and deep realized losses suggests that a market bottom is near or already forming.

If this bottom confirms, Bitcoin could rebound and break through the $86,822 resistance. A move above that level may enable a rally to $89,800 and then $91,521. Clearing these barriers would restore bullish sentiment, potentially driving BTC toward $95,000 in the short term.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if bearish pressure intensifies and macro conditions fail to improve, Bitcoin may break below $85,204. A decline under $82,503 would expose the price to a deeper fall toward $80,000, invalidating the bullish thesis and delaying recovery.

The post Did Bitcoin Just Bottom Out? What the Data Says About a Rebound appeared first on BeInCrypto.