Crypto market wipes out $500 bn in a week; Bitcoin down 20%, slips 7% in a day

Synopsis

The cryptocurrency market experienced a significant downturn, with nearly $500 billion wiped off its total value in a week. Bitcoin and Ethereum saw substantial drops, reflecting a broader risk-off sentiment in global markets. Analysts suggest this volatility is driven by macro factors and elevated leverage, with near-term price action expected to be range-bound.

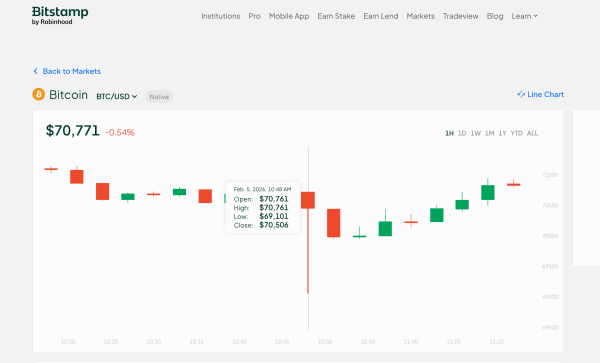

The cryptocurrency market remained under pressure after nearly $500 billion was wiped off its total value over the past week. Bitcoin fell about 20% during the period to around $70,000, including a sharp 8% drop in a single day. The cryptocurrency was trading at $70,122 on Thursday.

Ethereum slid 7.89% over the past 24 hours to trade near $2,091. Among major altcoins, BNB, XRP, Solana, Tron, Dogecoin and Cardano declined more than 6%, while Hyperliquid rose 0.52%. The global cryptocurrency market capitalisation fell 6.47% to $2.42 trillion, according to .

Also Read | Silver ETFs crash up to 21%, gold ETFs slide 7% as bullion sinks on MCX. What should investors do?

Crypto TrackerTOP COINS (₹) Tether90 (-0.16%)Ethereum189,474 (-7.2%)Bitcoin6,380,884 (-7.27%)BNB62,482 (-8.38%)XRP130 (-9.07%)Nischal Shetty, Founder of WazirX, said the recent decline in Bitcoin is best understood as part of a broader risk-off move across global markets rather than a crypto-specific shock. The fall in crypto market cap is due to selling pressure in global equities, particularly technology stocks, that spilled over into digital assets. Elevated leverage in crypto amplified the move, triggering a wave of forced liquidations as prices fell rapidly.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Shetty further said that market sentiment remains fragile, shaped by tightening liquidity conditions, uncertainty around global growth and caution ahead of key macroeconomic data and corporate earnings. Until broader risk sentiment stabilises and leverage resets more fully, Bitcoin’s movement is expected to remain range-bound and technically driven rather than trend-led

Live Events

In the past week, Bitcoin and Ethereum fell by 20.20% and 29.32%, respectively. Among the major altcoins, BNB, XRP, Solana, Tron, Dogecoin,and Cardano went down by over 26%, whereas Hyperliquid was up by 5.87%.

Akshat Siddhant, Lead quant analyst, Mudrex said Bitcoin continues to trade under pressure as buyers remain cautious despite the U.S. government ending its partial shutdown, a move that should gradually ease liquidity conditions.

The current volatility reflects broader macro sensitivity rather than any crypto-specific weakness. Geopolitical tensions between the U.S. and Iran are also keeping risk appetite in check, though ongoing dialogue offers scope for sentiment to improve.

Market perspective:

CoinSwitch Markets Desk

The move lower lacked a clear catalyst and appears largely sentiment-driven, with even constructive US–China commentary from President Trump failing to lift risk appetite. Immediate support now sits near $71.5K, while a clean break could expose the $66K–$68K zone. Unless BTC reclaims $75K, near-term risk stays skewed to further downside or volatile consolidation

Also Read | MF Tracker: Will this 3 and 5 year top performer PSU fund continue to maintain its rally?

Vikram Subburaj, CEO, Giottus

Bitcoin stayed under pressure, and this came after an intraday high near $76,806 and a low around $71,740. This range underscored how quickly liquidity thins when risk appetite fades.

With major US data due shortly, investors should prioritise risk management, stagger entries, and avoid leverage until price reclaims stronger support above the mid-$70,000s. That said, it is prudent to keep accumulating at this price point. Investors should use instruments like SIPs to gradually add to their portfolio.

Piyush Walke, Derivatives Research Analyst, Delta Exchange

Cryptocurrencies remained under sustained pressure, reflecting broader cross-asset stress. While the initial sell-off phase was driven by crypto-specific liquidations, Wednesday’s weakness pointed to wider risk-off sentiment across asset classes.

Bitcoin is now down about 17% so far this year, while the overall cryptocurrency market has lost more than $460 billion in value over the past week.