Critical Hours Ahead: What Will the Fed Decide, What Will Powell Say? How Will This Affect Cryptocurrencies? The Chinese Have Spoken

Cryptocurrency analytics company QCP Capital shared its assessment of Bitcoin and the overall market outlook following the sharp sell-off at the beginning of the week.

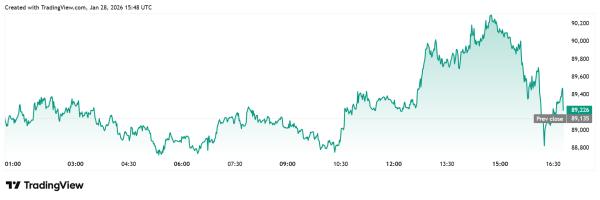

According to QCP Capital, Bitcoin has recovered after its sharp decline earlier in the week. However, this level has recently acted as a “trap” for the market. Drops below $88,000 typically lead to rapid and deep gaps due to liquidations, while a quick retracement pulls the price back into a horizontal range. The analysis notes that Bitcoin’s current technical outlook coincides with a busy US macroeconomic agenda.

QCP Capital stated that uncertainties surrounding today’s FOMC interest rate decision, the US budget financing deadline of January 30th, and the Senate’s market structure bill for the crypto market are putting pressure on the market. Additionally, they argued that the recent “currency control” signal in the USD/JPY pair, highlighting how quickly crowded positions can be unwinded, is also limiting risk appetite due to stress in the currency markets.

Looking at the options markets, it was noted that volatility remained relatively limited and the futures volatility curve still exhibited contango. This indicated that the main scenario was a volatile and sideways trend rather than a sharp collapse.

On the fiscal front, the main question is how smoothly Washington will navigate the January 30th deadline. A short-term temporary budget agreement could lower risk premiums, allowing crypto assets to trade with a greater overall market beta. However, a warning was issued that a short-term shutdown could trigger a temporary wave of risk aversion, while a prolonged impasse could severely tighten liquidity, triggering more widespread position reduction.

According to QCP Capital, the most critical issue in the near term is the Fed. While the base scenario is that interest rates will remain unchanged, the market’s main focus is on when interest rate cuts will resume. Despite inflation still hovering above 2% and signs of easing in the labor market, the Fed is expected to maintain a cautious and data-dependent stance. The analysis also states that, considering the ongoing debates about the Fed’s independence, an unexpectedly dovish tone is unlikely.

The company assessed that a “hawkish fixed interest rate” decision could support the dollar in the short term and create temporary volatility in risky assets, but if the Fed emphasizes that the strong dollar and tightening in foreign exchange markets are already challenging financial conditions, the weakening trend in the dollar could be maintained in the medium term.

*This is not investment advice.