BlackRock just spent over $300 million buying this crypto

BlackRock just spent over $300 million buying this crypto

![]() Cryptocurrency Aug 26, 2025 Share

Cryptocurrency Aug 26, 2025 Share

The world’s largest investment firm, BlackRock, continues to flex its muscle in the cryptocurrency space through the steady accumulation of assets via spot exchange-traded funds (ETFs).

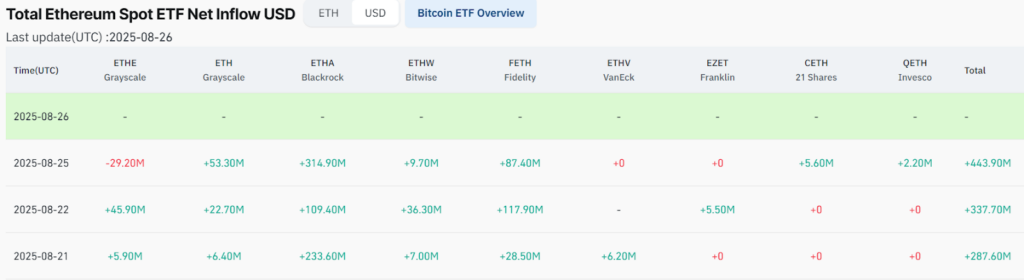

To this end, data indicates that the company poured $314.9 million into its Ethereum spot ETF (ETHA) on August 25, marking one of the biggest single-day inflows since trading began.

The move was part of a broader buying spree across multiple issuers. For instance, Fidelity attracted $87.4 million, Bitwise added $9.7 million, while Grayscale’s ETH fund recorded $53.3 million in net inflows despite a $29.2 million outflow from its ETHE product.

Invesco and 21Shares also posted smaller gains of $2.2 million and $5.6 million, respectively. In total, Ethereum spot ETFs drew $443.9 million in fresh capital on Monday.

The August 25 surge wasn’t an isolated event. Just days earlier, on August 22, BlackRock recorded another $109.4 million inflow, while Fidelity pulled in $117.9 million and Bitwise added $36.3 million, bringing the day’s total to $337.7 million.

Ethereum ETF net inflow. Source: Coinglass

Ethereum ETF net inflow. Source: Coinglass

On August 21, BlackRock saw an even larger inflow of $233.6 million, contributing to a combined $287.6 million across issuers.

Ethereum’s momentum to $5,000

Indeed, BlackRock continues to show strong interest in Ethereum after the asset’s recent price momentum near the $5,000 mark.

Notably, after the cryptocurrency briefly touched an all-time high just shy of $5,000, the second-ranked digital asset by market cap has since retraced in line with broader market sentiment.

By press time, Ethereum was trading at $4,530, down 1% in the last 24 hours. However, over the past week, the asset has gained more than 8%.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

As things stand, Ethereum’s main hurdle is retaining the $4,500 support zone, which is key to opening the door toward the $5,000 milestone.

Featured image via Shutterstock