Bitcoin whales dump over 80,000 BTC as holdings hit 9-month low

Bitcoin whales dump over 80,000 BTC as holdings hit 9-month low

![]() Cryptocurrency Feb 6, 2026 Share

Cryptocurrency Feb 6, 2026 Share

Bitcoin (BTC) whales and large holders have sharply reduced their exposure as the cryptocurrency slid toward the $60,000 level, according to fresh on-chain data.

Namely, blockchain analytics show that so-called whale and shark wallets, that is, those holding between 10 and 10,000 BTC, have been steadily reducing their exposure to the asset, judging by statistics published by crypto data intelligence platform Santiment on February 5.

Specifically, these large holders now control “only” 68.04% of the total Bitcoin supply, a nine-month low, having dumped roughly 81,068 BTC over the past eight days alone. According to the same data, the new figure suggests increased selling pressure from major market participants during the recent downturn.

Bitcoin whale and shark statistics. Source: Santiment

Bitcoin whale and shark statistics. Source: Santiment

Small-cap Bitcoin holders continue to buy

In contrast to whales, small-cap Bitcoin investors, often called “shrimps,” appear to be moving in the opposite direction. Indeed, these more modest wallets holding less than 0.01 BTC now account for 0.249% of total supply, a 20-month high. While the share remains small in absolute terms, Santiment suggests the rise reflects persistent retail dip-buying despite the broader market weakness.

Remittix Wallet Sees Over 100,000 Downloads After Project Gives Back to Investors With 300% Bonus

In a crypto market where many launches struggle to convert attention into real usage, a growing number of investors are … Continue reading

Featured Press Release Feb 5, 2026

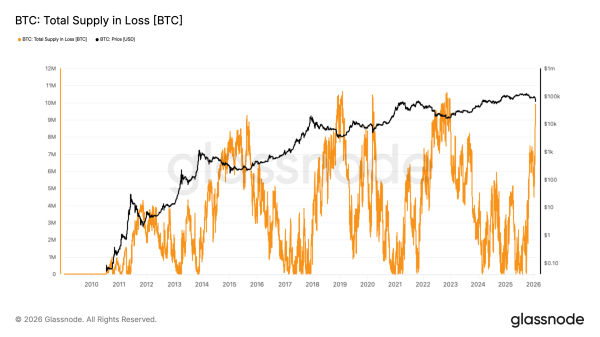

Historically, however, this kind of setup, i.e., large holders distributing coins while retail accumulates, has often marked the early stages of bear market cycles. Accordingly, until retail investors show clearer signs of capitulation, larger players are more likely to remain comfortable selling, feeling little urgency to get back into the market.

In sum, the data appears to suggest that the Bitcoin correction is driven less by panic selling and more by a structural handoff from institutional-scale wallets to smaller, long-term hopeful buyers. This pattern, if history is anything to go by, implies we might be heading toward longer periods of price consolidation or further downside.

Featured image via Shutterstock