Bitcoin slides toward $113,000, Ethereum near $4,100: Here’s what experts say

Synopsis

Bitcoin slipped toward $113,000 and Ethereum neared $4,100 as profit-taking, US tariffs, and inflation concerns weighed on sentiment. Experts flagged short-term holder capitulation, ETF outflows, and regulatory probes, but highlighted resilient support levels and whale accumulation as key factors shaping the next move.

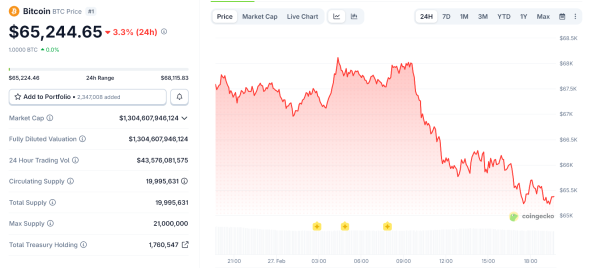

Bitcoin slipped toward $113,000 on Wednesday after hitting an all-time high of $124,000 just a week ago, while Ethereum hovered around $4,100, reflecting the unease rippling through the market, according to analysts.

“The crypto market is caught in a fragile moment, where sentiment is swinging faster than prices themselves. Bitcoin slipping toward $113,000 and Ethereum near $4,100 captures the unease rippling through the market. Inflation worries, fading demand, and profit-taking have weighed on momentum, while Ethereum’s record short interest signals elevated liquidation risk,” said Avinash Shekhar, Co-Founder & CEO, Pi42.

Also Read | Edtech working with Ivy League universities first to file for Gujarat’s GIFT City IPO

At 9:57 AM IST, Bitcoin was trading at $113,636, down 1.12% over the past 24 hours and 5% over the past week.

Crypto TrackerTOP COINS (₹) Solana15,685 (-0.03%)BNB72,674 (-1.54%)Bitcoin9,888,165 (-1.79%)Ethereum362,343 (-2.15%)XRP252 (-4.36%)

Ethereum, on the other hand, was trading at $4,167, down 0.92% in the past 24 hours and 11% over the last seven days.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

According to data from , the crypto sector’s overall market capitalisation stood at around $3.82 trillion on Wednesday.

Another expert says that Bitcoin (BTC) is facing a pullback after last week’s all-time high of $124,500, slipping to $113,578 amid caution ahead of Jerome Powell’s Jackson Hole address.

“The price has dropped 7.6%, triggering significant capitulation among short-term holders (STHs). On-chain data from CryptoQuant shows over 20,000 BTC held for less than 155 days were sold at a loss since Sunday,” said Sathvik Vishwanath, Co-Founder & CEO, Unocoin.

“Loss-taking peaked Tuesday, with 23,520 BTC sent to exchanges, coinciding with a 3.5% decline from $118,600 to $114,400, according to Glassnode. Despite this pressure, analysts suggest bears may struggle to push BTC below $100,000 given resilient technical support levels,” Vishwanath added.

Also Read | Jio Financial Services & Reliance Industries among stocks bought and sold by PPFAS Mutual Fund in July

Experts’ Take

Edul Patel, Co-founder and CEO of Mudrex

Bitcoin is trading above the $113,400 mark as global markets react to Trump’s 50% additional tariffs on aluminium and steel products. These tariffs have raised concerns about economic contraction in the US, creating a risk-off sentiment. However, macroeconomic factors like the declining dollar strength increased the appeal for non-sovereign assets, pointing towards a trend reversal. Plus, Bitcoin Whales have added over 20,000 BTC in the past week, showing strong demand for the asset. For now, Bitcoin needs to defend the $112,000 support. If it failed, BTC could test the $110,000 zone before a relief rally.

Vikram Subburaj, CEO, Giottus.com

Bitcoin’s sharp drop below $113,000 today was fueled by a mix of macro and market-specific headwinds, from new US tariffs and inflation concerns, to a US SEC probe into a partner of World Liberty Financial, and even broader weakness in equities. Together, these factors triggered $116 million in long liquidations and drove options markets into “fear” territory, with skew hitting its highest levels in four months.

Institutional demand via spot ETFs will likely dictate how this plays out. Spot ETFs collectively had a new outflow of $523 million today on top of $121 million outflow yesterday. If inflows fail to re-ignite, Bitcoin risks sliding into deeper consolidation before any recovery. Altcoins mirrored the move lower. XRP, Cardano and Chainlink all shed over 4%, while most other majors saw modest declines.