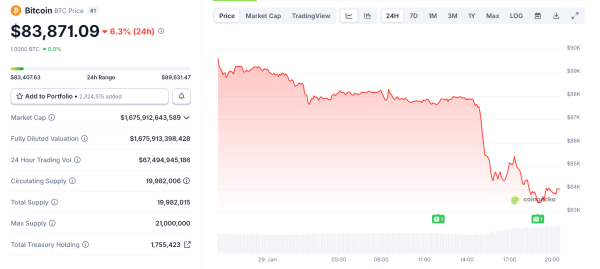

Bitcoin sinks below $82,000, lowest in 2 months as Fed chair speculation rattles risky assets

Synopsis

Bitcoin and major cryptocurrencies saw a sharp fall. Bitcoin hit a two-month low amid worries about the Fed’s stance. This led to a broad market sell-off. Over $1.7 billion in leveraged positions were liquidated. Analysts suggest the market could stabilize if key support levels hold. Hyperliquid bucked the trend with a significant rise.

![]()

Listen to this article in summarized format

Listen Loading…×× Subscribe to

Unlock AI Briefing and Premium Content

Subscribe Now

What’s Included

- Exclusive Stories

- Daily ePaper Access

- Smart Market Tools

- Curated Investment Ideas

- Ad-lite Experience

Subscription

Subscription

Bitcoin fell below $82,000 on Friday, hitting its lowest level in two months as uncertainty over the Fed chairmanship stoked fears of a more hawkish stance than investors had anticipated.

In Singapore trading, Bitcoin fell as much as 3.9% to $81,102, its weakest level since November 21, extending a rout that accelerated overnight. The cryptocurrency is now down more than 34% from its all-time high on October 6.

Over the past 24 hours, Bitcoin declined 6%, while Ethereum dropped 7% to $2,747. Major altcoins, including BNB, XRP, Solana, Tron, Dogecoin, Cardano, and Hyperliquid, also fell nearly 7% in the same period.

Crypto TrackerTOP COINS (₹) Tether92 (-0.06%)Bitcoin7,581,746 (-6.5%)BNB77,169 (-6.76%)XRP160 (-7.79%)Ethereum249,790 (-7.89%)Cryptocurrencies are enduring a rough patch, putting an end to hopes of a “golden era” of strong inflows and favorable regulation under US President Donald Trump. Bitcoin has lost roughly a third of its value since reaching record highs in October.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Also Read | South Indian Bank shares fall by 19% post CEO not seeking reappointment

Live Events

The global crypto market capitalisation slipped 5.56% to $2.82 trillion, according to .

Riya Sehgal, Research Analyst at Delta Exchange, said the crypto market witnessed one of its sharpest corrections in months, with more than $1.7 billion in leveraged positions liquidated over the past 24 hours. The selloff followed a broader global risk-off move, triggered by weak technology earnings.

Sehgal noted that while short-term momentum remains bearish, the market could stabilise if Bitcoin and Ethereum hold key support levels near $80,000 and $2,700, respectively, as volatility begins to cool.

Over the past week, Bitcoin and Ethereum have fallen more than 7%, while major altcoins—including BNB, XRP, Solana, Tron, Dogecoin and Cardano—are down over 10%. Hyperliquid, however, has bucked the trend, rising 35% during the same period.

Nischal Shetty, Founder, WazirX, said this drop was largely driven by liquidation of excess leverage, with over $777 million in long positions liquidated in just one hour, as this shows a broader reaction to macroeconomic developments which have been triggering outsized moves in risk-on assets.

Shetty further said that uncertainty around Fed chairmanship has stirred speculation of a more hawkish outcome than some had hoped for, pushing investors into a risk-off mindset and adding pressure on crypto prices.

Market perspective

Vikram Subburaj, CEO, Giottus

The immediate trigger was a decisive break below the $85,000 support zone. This level had acted as a short-term floor through much of mid-January.

CoinSwitch Markets Desk

BTC slipped below the $85k level in an already fragile market environment, where escalating US-Iran tensions and increasing probability of a US government shutdown triggered a broad risk-off response.

Also Read | Railway-focused mutual funds lose up to 8% since last Budget. Is 2026 time to stay invested or exit?

Akshat Siddhant, Lead quant analyst, Mudrex

Currently trading around $81,000, BTC presents an attractive opportunity for long-term investors, where gradual, disciplined accumulation can help achieve better risk-adjusted returns over time. However, traders should closely watch the $80,600 support level, as a break below it could trigger further downward pressure.