Bitcoin rebounds near $64,000 after intraday slide to $60,000 amid macro and AI sector worries

Synopsis

Bitcoin rebounded to around $64,000 after slipping to an intraday low of $60,000, as softer U.S. labour data and concerns over heavy AI-sector capital spending weighed on risk sentiment. Despite the recovery, Bitcoin and Ethereum fell about 9% in the past 24 hours.

Bitcoin recovered to around the $64,000 level after falling to an intraday low of $60,000 on Friday, as softer U.S. labour data and concerns over heavy AI-sector capital spending weighed on broader risk sentiment. The cryptocurrency was trading at about $64,845 during the session.

Over the past 24 hours, Bitcoin and Ethereum declined 8.93% and 9.79%, respectively. Among major altcoins, BNB, XRP, Solana, Tron, Dogecoin, and Cardano dropped more than 14%, while Hyperliquid rose 2.7%.

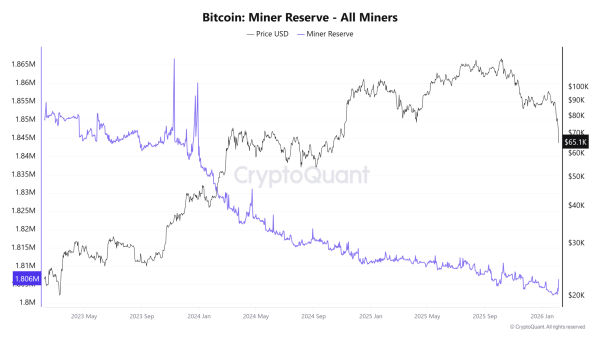

Akshat Siddhant, Lead quant analyst, Mudrex, said that continued ETF outflows and short-term holders moving nearly 60,000 BTC to exchanges have added to near-term selling pressure. That said, for long-term investors, this phase offers a favourable accumulation opportunity through disciplined, staggered buying.

Crypto TrackerTOP COINS (₹) Tether90 (-0.12%)Bitcoin5,936,755 (-7.42%)BNB57,205 (-8.74%)Ethereum174,237 (-8.91%)XRP118 (-9.49%)Also Read | Gold and silver ETFs crash up to 10% for the second day. What should investors do?

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »The global crypto market capitalisation edged down 8.41% to $2.21 trillion, according to .

Live Events

CoinDCX Research Team said the latest plunge has wiped out more than $350 billion from the markets, with over $2.2 billion in longs liquidated.

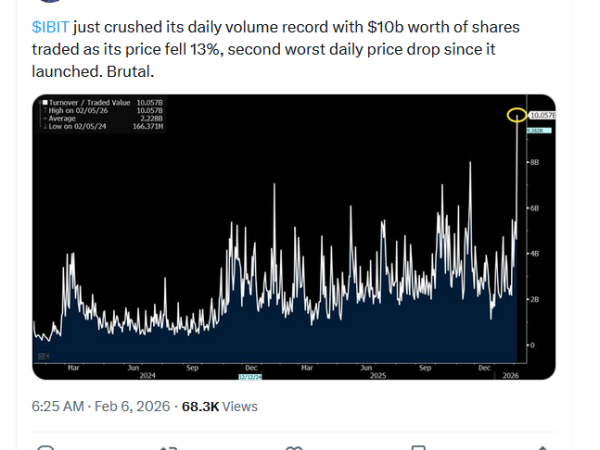

The cryptocurrency made a 16-month low, dropping below key $60,000 support on Friday, as a global selloff in technology stocks deepened and washed out risky bets across asset classes.

It marked Bitcoin’s weakest level since October 2024, a month before Donald Trump won the U.S. presidential election, after he had publicly signalled his intention to support cryptocurrencies during his campaign.

In the past week, Bitcoin and Ethereum went down by 21.76% and 30.76%, respectively. Among the major altcoins, BNB, XRP, Solana, Tron, Dogecoin, and Cardano fell over 32%, and Hyperliquid gained 19.12%.

Vikram Subburaj, CEO, Giottus, said the immediate trigger for the sell-off has been a decisive break below key technical and cost-basis levels. Assess your risk tolerance well and consider these lower price points a good time to accumulate BTC. Do not pump capital in. Use products like crypto SIPs to buy more.

Also Read | Thinking of pausing your mutual fund SIPs? A 6 month gap may cost you Rs 2 lakh additional loss

Here’s how other experts decode this fall

CoinSwitch Markets Desk: Markets saw sharp selling as risk appetite weakened, pointing to a broad liquidity squeeze rather than asset-specific stress. The total crypto market cap fell over 10% in a single day, an unusual correlation that signals leverage unwinds and margin-driven selling.

Riya Sehgal, Research Analyst, Delta Exchange: The move represented a significant 17% intraday swing, reflecting heightened volatility across the crypto market. The broader sentiment turned decisively risk-off, with the Crypto Fear & Greed Index plunging to 5 (Extreme Fear), its lowest reading since mid-2023.