Bitcoin Price Recovers Above Key Level Despite Record ETF Outflows

- The Bitcoin price reversal gained traction as buyers reversed a bearish breakdown from yearly support.

- The BTC rebound gained momentum after the dovish Fed signals hinting at a 25 bps cut at the December meeting.

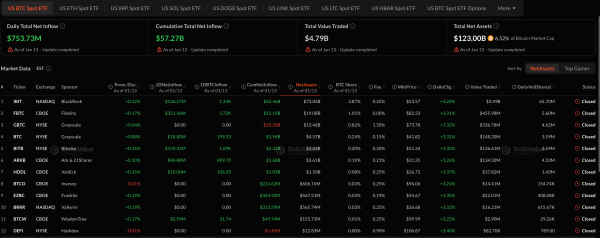

- Last week, the U.S.-based spot Bitcoin ETFs recorded a net weekly outflow of $1.22 billion.

Since last weekend, the Bitcoin price has shown a notable recovery, reclaiming its $88,000. The buying pressure can be attributed to dovish comments from U.S. Federal Reserve officials, which raised the market’s anticipation for a potential rate cut in December. This relief rally is gradually gaining momentum and heading for key resistances to check sustainability. Will the BTC upswing shift into a renewed recovery trend?.

Record ETF Outflows Cast Shadow Over Bitcoin Price Recovery

Over the past four days, the Bitcoin price showed a bullish rebound from $80,537 to the current trading price of $88,942, registering a 10.42%. This upswing was triggered as Fed officials stated a dovish stance for a 25 basis point rate cut at the December 9-10 FOMC meeting.

Key comments came from New York Fed President John Williams, who suggested “room for further adjustment” toward a neutral policy stance, and Fed Governor Christopher Waller, who expressed support for a December cut amid cooling inflation data.

While Bitcoin is trying to claw back losses, market focus has shifted to the heaviest outflow streak ever witnessed in BlackRock’s iShares Bitcoin Trust (IBIT). Through last Friday, about $2.2 billion left the fund in November alone, a drastic turnaround from the steady inflows that characterized the fund’s first 10 months.

The move led to crypto enthusiast Walter Bloomberg pointing out that “Investors are pulling cash out of BlackRock’s iShares Bitcoin Trust ETF at the fastest rate ever, with $2.2 billion leaving in November through Friday.” Bitcoin itself is down about 22% in the past month and is down 7% year-to-date.

Bloomberg ETF analyst Eric Balchunas pushed back on the alarm, writing, “That’s because it never had outflows before! All told, the ‘record’ is 3% of AUM. The real story (that you won’t see in ALL CAPS, let alone in the media at large) is 97% of investors are sticking around in spite of not starting the -35% fire.”

Market participants are now counting whether fresh ETF inflows, combined with the prospect of Federal Reserve rate cuts in December, could provide enough tailwind to reverse the downtrend and fuel a stronger recovery leg at Bitcoin’s price.

BTC Gain Momentum Amid Fake Support Breakdown

By press time, the Bitcoin price recorded a 2.46% intraday jump to currently trade at $88,922. This upswing tends to reverse the recent breakdown attempt from a long-coming support in the daily chart. The dynamic support was a major accumulation zone for buyers since October 2023, and therefore, the recent breakdown had initially sparked additional selling pressure in the market.

Today’s price jump, backed by increasing trading volume, accentuates a growing conviction from buyers to regain lost ground. If materialized, the Bitcoin price could bounce another 8% before challenging major resistance from an overhead resistance trendline at $96,000.

The downsloping trendline currently acts as a dynamic resistance and drives the short-term pullback in BTC. A potential breakout from this barrier could potentially build sufficient momentum for a renewed recovery trend.

BTC/USDT – 1d Chart

BTC/USDT – 1d Chart

On the contrary, if the sellers continue to defend this barrier, the current correction could extend and challenge the $80,500 support.