Bitcoin hovers near $69,700 as market volume shrinks to $111 billion. What experts say

Synopsis

Bitcoin saw a dip to $69,700 with trading volumes dropping significantly. Major cryptocurrencies like Bitcoin and Ethereum fell up to 2 percent. Other altcoins experienced over 6 percent declines. The global crypto market capitalization also decreased. Experts note Bitcoin is consolidating around $70,000, with institutional investors buying the dip.

![]()

Listen to this article in summarized format

Listen Loading…×× Subscribe to

Unlock AI Briefing and Premium Content

Subscribe Now

What’s Included

- Exclusive Stories

- Daily ePaper Access

- Smart Market Tools

- Curated Investment Ideas

- Ad-lite Experience

Subscription

Subscription

Bitcoin slipped to $69,700 on Tuesday as the 24-hour trading volume fell sharply from over $300 billion to nearly $111 billion. The cryptocurrency was trading at $69,678.

In the past 24 hours, Bitcoin and Ethereum fell up to 2%. Other altcoins, such as XRP, BNB, Solana, Tron, Dogecoin, Cardano, and Hyperliquid fell over 6%. The global crypto market capitalisation dropped 1.57% to $2.38 trillion, according to .

Also Read | Silver ETFs deliver 62% XIRR since launch, outpace gold ETFs’ 42%. Should allocation strategies change?

Crypto TrackerTOP COINS (₹) XRP130 (0.42%)Tether91 (0.28%)BNB57,407 (-0.01%)Bitcoin6,257,565 (-1.82%)Ethereum183,992 (-2.05%)According to the CoinDCX Research Team, Bitcoin maintains a horizontal consolidation, hovering around $70,000 with a minimal bullish and bearish impact. The overall market sentiment remains in fear but is trying to stabilise.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

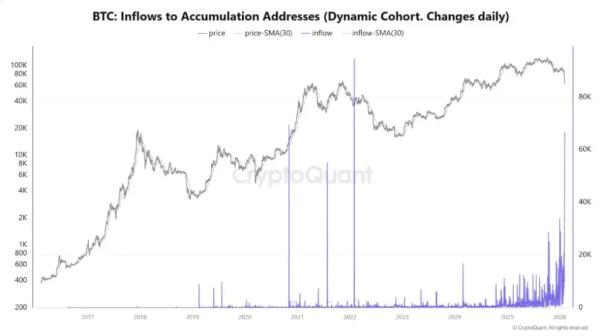

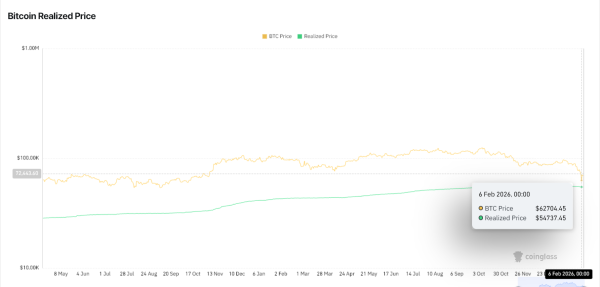

View Details »Akshat Siddhant, Lead Quant Analyst, Mudrex, said that Bitcoin is holding strong as whales and institutional investors step in to buy the dip. Since Friday, large holders have accumulated over 40,000 BTC, helping stabilise prices, while Strategy added 1,142 BTC worth about $90 million, showing long-term institutional confidence.

Live Events

In the past week, Bitcoin and Ethereum fell 11.76% and 12.25%, respectively. Meanwhile, XRP, BNB, Solana, Tron, Dogecoin, Cardano, and Hyperliquid went down over 19%.

Vikram Subburaj, CEO, Giottus, said that this drop has flushed out leveraged positioning and dragged broader sentiment into “risk-off” mode. The rebound has been reactive rather than exuberant.

What other experts say

CoinSwitch Markets Desk

BTC remains range-bound between $68K and $71K, consolidating as traders stay cautious due to broadly bearish sentiment and a lack of near-term catalysts. Markets appear to be waiting for direction from other assets before capital rotates back into BTC.

Riya Sehgal, Research Analyst, Delta Exchange

Outflows from digital asset products eased to $187 million last week, suggesting moderating selling pressure amid cautious sentiment. Macro drivers, U.S. CPI data and Fed policy signals will shape near-term sentiment, while extreme fear readings and rising on-chain activity suggest conditions for a medium-term rebound remain intact.

Also Read | Build a boring thali: Radhika Gupta’s 65-10-10-15 multi-asset formula for your portfolio

Nischal Shetty, Founder, WazirX

While Bitcoin held $70,000 levels yesterday, the token recorded a dip in the last 24 hours, reaching $69K as investors globally show a lack of confidence in risk-on assets, at least in the near term.

Crypto experts, with historically longer exposure to digital assets, remain optimistic about Bitcoin’s long-term potential and cite the current volatility to similar downsides observed in the market previously. However, the cryptocurrency has overcome these downsides in the past and continues to reach new highs.