Bitcoin drops by nearly 4% to $114K in one week. Experts hint at consolidation phase

Synopsis

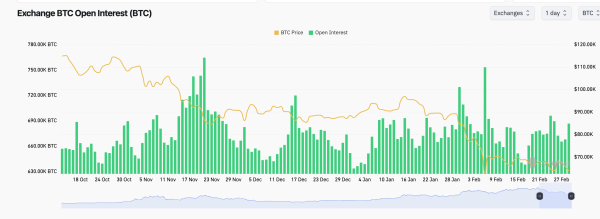

Bitcoin fell nearly 4% in a week to around $114K, consolidating below $116K on macro headwinds. Analysts say rising open interest near $115K could provide short-term support unless demand weakens.

Bitcoin dropped nearly 4% to $114K in one week, reflecting consolidating below $116,000 on macro headwinds.

The cryptocurrency reached the level of $114,993. At 9:43 AM IST, the world’s largest cryptocurrency was down marginally by 0.43% over the past 24 hours. In the last seven days, it declined 3.45%.

Also Read | Rs 10,200 crore bet! SBI becomes top pick of mutual funds in July

“Bitcoin extended its pullback and is consolidating below $116,000 on macro headwinds. The price action has played out as a classic liquidity sweep on thin weekend order books. Importantly, open interest has surged as price swept into the $115,000 region, creating a zone of trapped shorts alongside new long positioning. This dynamic is likely to serve as near-term support, cushioning further downside unless spot demand meaningfully dries up,” said Vikram Subburaj, CEO, Giottus.com.

Crypto Tracker![]() TOP COIN SETSCrypto Blue Chip – 5-3.92% BuyBTC 50 :: ETH 50-4.80% BuyWeb3 Tracker-7.04% BuyAI Tracker-8.36% BuyDeFi Tracker-11.53% BuyTOP COINS (₹) BNB73,827 (1.17%)BuyXRP264 (0.6%)BuyBitcoinNaN (-0.3%)BuySolana15,691 (-1.71%)BuyEthereum370,082 (-1.76%)Buy

TOP COIN SETSCrypto Blue Chip – 5-3.92% BuyBTC 50 :: ETH 50-4.80% BuyWeb3 Tracker-7.04% BuyAI Tracker-8.36% BuyDeFi Tracker-11.53% BuyTOP COINS (₹) BNB73,827 (1.17%)BuyXRP264 (0.6%)BuyBitcoinNaN (-0.3%)BuySolana15,691 (-1.71%)BuyEthereum370,082 (-1.76%)Buy

According to data from , the crypto sector’s overall market capitalisation was at $3.87 trillion.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

Another expert says that Bitcoin is navigating a critical zone at $115,500, where buyers and sellers are finely balanced. The market’s safety net lies at $115,000, with deeper cushions stacked at $114,000 and $112,000, levels that historically attract strong demand.

“A sharper fallback could even test the $109,000 base, a zone that has anchored prior rebounds. On the upside, $116,500 is the first real gate to unlock momentum, followed by $119,000 and the psychological $121,000 mark. Should enthusiasm intensify, $123,000 becomes the defining battleground. Current positioning suggests Bitcoin is coiling for its next decisive move, with volatility set to reawaken,” said Sathvik Vishwanath, Co-Founder & CEO, Unocoin.

Also Read | 60 equity mutual funds turn Rs 10,000 SIP to over Rs 1 crore in 2 decades

Ethereum

Ethereum was recorded at the level of $4,213, and in the past 24 hours, it has gone down by 2.56%. In a one week horizon, it has gone down by 1.93%. “The market turbulence earlier this week rattled sentiment, but the pullback looks more like a reset than a breakdown. Monday’s $500 million in crypto liquidations, spanning across markets, was the shock flex rebalancing that likely triggered sharp moves in both Bitcoin and Ethereum, said Avinash Shekhar, Co-Founder & CEO, Pi42.

“Yet, Bitcoin is holding near critical levels, even after sweeping liquidity zones and the rebound in open interest signals enduring conviction by serious players. Ethereum is experiencing pain, caught in the broader market unwind, but is showing signs of resilience because of the strong fundamentals. XRP’s supply hold pattern suggests accumulation at discounted levels is already underway. Rather than weakness, this phase may be setting the stage for a measured but determined climb higher,” he added.