Bitcoin Derivatives Heat up as CME Leads, Options Lean Call-Heavy

Bitcoin changed hands around $115,685 on Sunday afternoon, and derivatives desks were anything but sleepy as futures and options activity stacked up across venues. Spot markets don’t even need drama; positioning is doing all the talking for now.

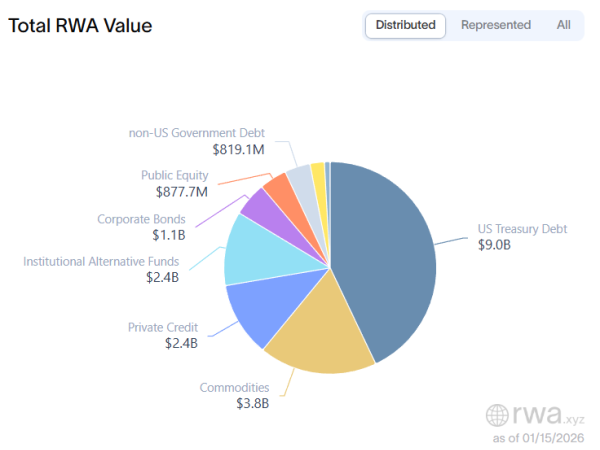

Bitcoin Open Interest Nears Cycle Highs

Futures first: total bitcoin ( BTC) open interest (OI), according to coinglass.com stats, hovers near the mid-$80 billion zone, pacing close to cycle highs. Among the 21 venues, CME wears the crown with $16.73 billion in open interest, equal to 144.81K BTC and a 20.08% share.

Bitcoin futures open interest on Sept. 14, 2025, according to coinglass.com.

Bitcoin futures open interest on Sept. 14, 2025, according to coinglass.com.

Binance follows with $14.70 billion (127.07K BTC; 17.63%), while Bybit holds $10.15 billion (87.82K BTC; 12.18%). Gate sits at $8.69 billion (10.42%), with OKX at $4.53 billion (5.43%) and HTX at $4.56 billion (5.47%). The big five firmly steer the board, but depth is broad, spreading across mid-tier venues like WhiteBIT, MEXC, and Coinbase.

Intraday dynamics are mixed. Kucoin’s 24-hour change shows a mild +0.91%, Bitunix is +2.52%, and several others are quite flat, while Bingx prints a sharp −30.42%. Smaller books include BitMEX at $393.67 million and Kraken at $383.18 million, with DYDX carrying a modest $55.23 million. However you slice it, the futures complex remains thick, and the notional tally has crept higher in step with spot.

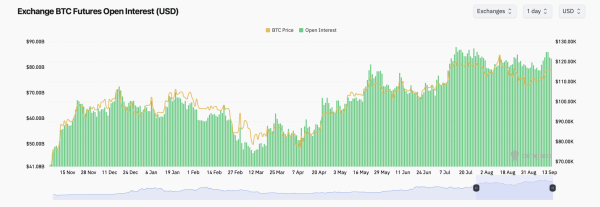

Max Pain Keeps Price in the Middle

Options figures tell an equally lively story, dominated by Deribit. Total bitcoin options open interest sits around the low-$50 billions and leans long: calls make up 59.97% of OI (253,574.9 BTC) versus 40.03% in puts (169,270.6 BTC). The past 24 hours, though, skewed slightly defensive, with puts at 52.76% of volume (4,070.3 BTC) and calls at 47.24% (3,644.41 BTC). Traders appear long gamma into strength, but they are paying for downside insurance.

Bitcoin options open interest on Sept. 14, 2025, according to coinglass.com.

Bitcoin options open interest on Sept. 14, 2025, according to coinglass.com.

The board’s heaviest lines cluster around familiar battlegrounds. The top OI contracts include the Sept. 26 $95,000 put (10,113.6 BTC), the Dec. 26 $140,000 call (10,022.5 BTC), and the Sept. 26 $140,000 call (9,985.6 BTC), alongside chunky September put interest at $108,000 and $110,000 and call demand near $115,000 to $116,000. That mix currently screams range with ambition.

Max pain levels line up with that read too. Near-dated expiries hover around $115,000, the quarterly Sept. 26 sits closer to $110,000, and the year-end cluster trends toward $100,000. In plain English: the path of maximum discomfort keeps magnetizing spot to the $110K–$115K pocket unless and until a fresh catalyst knocks it loose.

One more scoreboard note: the price-to-position dance still rhymes. As spot has marched higher since late summer, both of bitcoin‘s futures and options OI have climbed in tandem, a pairing that often amplifies whips when momentum flips. It basically means more leveraged positions are stacked in the same direction, so when sentiment flips, liquidations and hedging flows hit simultaneously and can exaggerate price moves a great deal.

Bottom line: the derivatives arena is fully loaded, CME and Binance are neck-and-neck on heft, and options traders are leaning bullish, but they are also well-hedged. If spot keeps flirting with six digits, expect fireworks into the Sep. 26 drumroll, where max pain says bring it back to the middle.