Bitcoin consolidates between $104,000 and $116,000 as market faces critical decision Point

Bitcoin (BTC) trades within a consolidation range between $104,000 and $116,000, with on-chain data revealing critical levels that could determine the next directional move.

According to a Sept. 4 report by Glassnode, Bitcoin entered a volatile downtrend following its mid-August all-time high, declining to $108,000 before rebounding toward current levels.

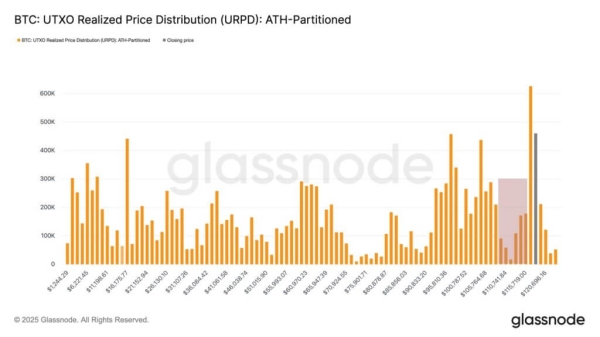

The UTXO Realized Price Distribution shows investors accumulated dursng the pullback, filling the $108,000-$116,000 “air gap” through consistent dip-buying behavior.

The current trading range corresponds to the 0.85 and 0.95 quantile cost basis levels, ranging from $104,100 to $114,300. Historically, this zone acts as a consolidation corridor following euphoric peaks, often producing choppy sideways markets.

Breaking below $104,100 would replay post-ATH exhaustion phases seen earlier this cycle, while recovery above $114,300 would signal renewed demand control.

Short-term holder trends

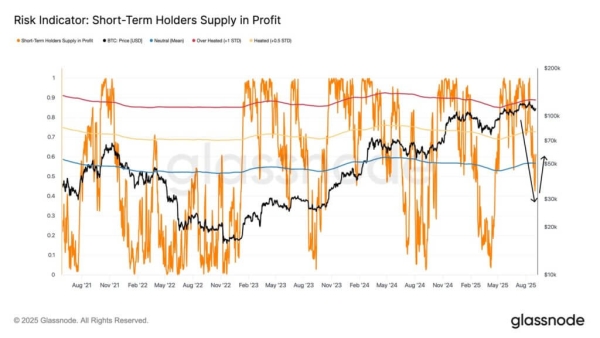

Short-term holders face mounting pressure within the range, with their profit percentage collapsing from above 90% to 42% during the decline to $108,000.

The sharp reversal typically triggers fear-driven selling from recent buyers before seller exhaustion enables rebounds.

Currently, over 60% of short-term holders have returned to profit, representing a neutral positioning compared to recent extremes.

Only sustained recovery above $114,000-$116,000, where over 75% of short-term holder supply would achieve profitability, could restore confidence necessary to attract new demand.

Futures market funding rates are sitting at $366,000 per hour, positioned neutrally between the established $300,000 baseline and overheated levels exceeding $1 million seen in March and December 2024.