Bitcoin and ether ETFs log their best week since October

Institutional investors are back and how.

The U.S.-listed exchange-traded funds (ETFs) investing in bitcoin BTC$93,038.29 and ether ETH$3,210.28 pulled in billions last week, registering their best week in three months.

The 11 spot bitcoin ETFs registered a net inflow of $1.42 billion last week, the largest tally since the second week of October, according to data source TradingView. BlackRock’s spot ETF, IBIT, alone saw inflows worth $1.03 billion.

This positive momentum wasn’t limited to bitcoin. Ether spot ETFs also experienced significant demand, attracting $479 million in inflows, their highest weekly total since early October. BlackRock’s fund, ETHA, secured a notable portion of this, bringing in $219 million.

On a year-to-date basis, bitcoin and ether ETFs have raked in $1.21 billion and $584.9 million, respectively.

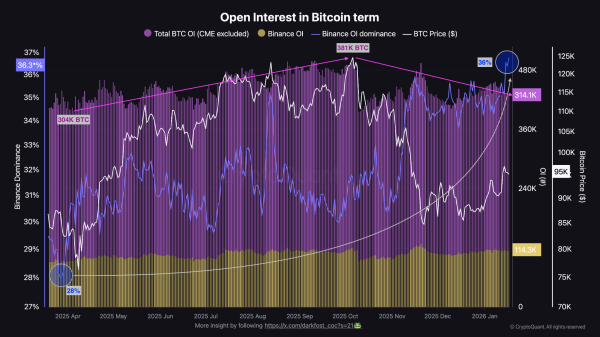

Experts noted that the majority of these inflows represent bullish positions, indicating a re-entry of “sticky” institutional capital into the market. This marks a move away from “cash and carry” arbitrage, which involved simultaneous long positions in ETFs and short positions in CME futures, as their yields have reportedly become less attractive.

In response, bitcoin’s price has risen by 6% to $92,600 this month, with ether rallying nearly 8% to $3,200, CoinDesk data show.

“The correlation between ETF inflows and price action suggests institutional capital is actively driving market structure rather than passively following retail sentiment. This pattern differs markedly from late 2025, when Bitcoin struggled despite moderate ETF interest,” CoinDesk’s market insights model said.

“The current dynamic indicates institutions are positioning ahead of potential regulatory clarity and macroeconomic shifts expected in Q1 2026,” it added.

For bitcoin and ether prices to rise meaningfully in the coming months, ETF inflows must sustain this momentum, after bleeding billions in late 2025.