Bernstein makes bullish 2026 Bitcoin price forecast

Bernstein makes bullish 2026 Bitcoin price forecast

![]() Cryptocurrency Feb 9, 2026 Share

Cryptocurrency Feb 9, 2026 Share

Through the sea of crash predictions for Bitcoin (BTC) permeating the media landscape of early 2026, Bernstein analysts took a completely contrarian stance, instead forecasting BTC will rally to a new all-time high (ATH) of $150,000 before the year is over.

Indeed, the experts at the brokerage and research firm, led by Gautam Chhugani, issued a note to investors on Monday, February 9, claiming that early 2026 features the ‘weakest bear case’ in the history of the world’s premier cryptocurrency.

According to Bernstein, Bitcoin has no shortage of bullish factors backing it, ranging from structural to political, and the recent sell-off is more the result of habit among cryptocurrency investors than a sign that the market is entering a new ‘crypto winter.’

Bernstein reveals why Bitcoin is headed to $150,000 in 2026

Specifically, the institutional analysts pointed toward growing adoption of BTC among major players such as banks and major investment firms as a clear sign that the situation is drastically different than in the previous cycles.

Bernstein also highlighted that the regulatory climate in the U.S. has never been more favorable toward digital assets and that there is a stark contrast between how the Biden administration handled the industry – former SEC Chair’s ‘war on crypto’ has been widely discussed for years – and how President Donald Trump’s White House is treating the sector.

Still, it is worth remembering that the U.S. government’s backing for digital assets is not entirely bereft of controversy, and not all significant voices from the ecosystem find the developments to be positive.

While the legislation – originally scheduled for a vote in January – was welcomed by Ripple Labs’ Brad Garlinghouse, both Coinbase’s (NASDAQ: COIN) Briand Armstrong and Cardano’s (ADA) Charles Hoskinson came out as opposed.

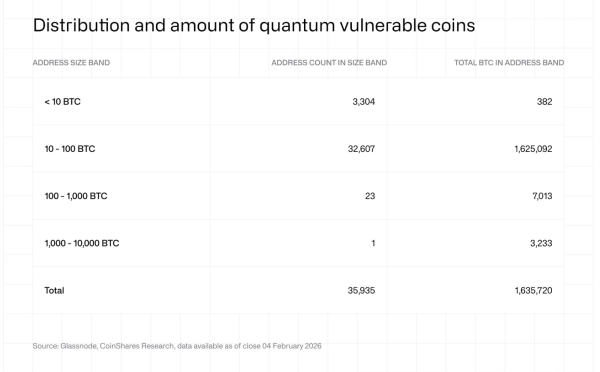

Lastly, the firm’s analysts also noted that, unlike in the previous crashes, there have been no major scandals or company collapses to drive a bloodbath, while any possible structural risks from factors like quantum computing are still in the future, and fail to isolate Bitcoin as the sole sufferer.

The 2026 Bitcoin bear case

It is true to an extent that much of the discussion surrounding why Bitcoin is headed toward a cycle low in 2026 has been rooted in the belief that crypto market cycles tend to repeat.

Varntix Digital Asset Treasury Model Gains Attention as Income Strategies Evolve

Income strategies in crypto are entering a new phase. For years, digital asset income generation has been largely tied to … Continue reading

Featured Press Release Feb 7, 2026

Notable blockchain analyst Ali Martinez based his forecast that BTC will crash toward $38,000 by October on the time the cryptocurrency usually takes to go from a bottom to a top and back. The on-chain expert also made the assumption that Bitcoin peaked in October when it crossed above $126,000.

More traditional prominent traders, such as the famed ‘Big Short’ investor Michael Burry, also appear to be looking for the future in the past.

Notably, Burred made a laconic X post earlier in February in which he appears to have forecasted a Bitcoin fall toward $40,000 by March, largely due to the similarities between the asset’s recent performance and the patterns seen in 2021 and 2022.

That being said, not all analysts outside Bernstein see only doom and gloom. Tom Lee seemingly endorsed the stance that the current downturn is ephemeral and that the situation is profoundly different compared to previous cycles on February 7.

The argument Bitcoin will rally later in 2026 apparently endorsed by Tom Lee. Source: Mike Alfred via X

The argument Bitcoin will rally later in 2026 apparently endorsed by Tom Lee. Source: Mike Alfred via X

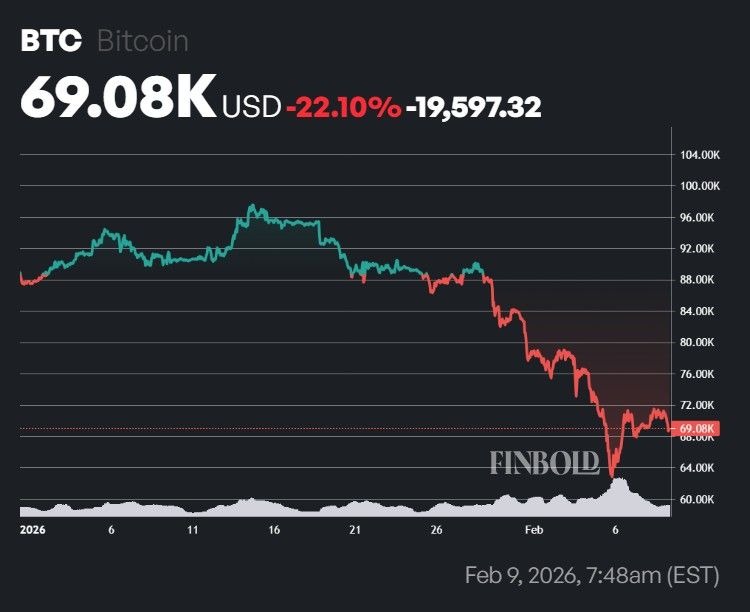

Bitcoin price crashes 22% in 2026

If Bitcoin is to meet Bernstein’s bullish forecasts, it would first have to break the downturn that has recently been affecting the cryptocurrency market. Though BTC recovered significantly from falling to approximately $60,000 late last week, it remains 22% down in 2026.

Bitcoin price YTD chart. Source: Finbold

Bitcoin price YTD chart. Source: Finbold

Indeed, the world’s premier cryptocurrency is, after a moderate bearish turn early on February 9, changing hands at $69,084, and Bernstein’s $150,000 2026 Bitcoin price forecast would need a 117% rally from the press time price to be met.

Featured image via Shutterstock