Bitcoin holds near $84,000 as markets react to Kevin Warsh’s Fed chair nomination

Synopsis

Bitcoin hovered near $84,000 as markets reacted to Kevin Warsh’s nomination as US Federal Reserve Chair. While short-term volatility persists amid ETF outflows and macro uncertainty, reduced leverage and oversold conditions may support a near-term rebound across major cryptocurrencies if sentiment stabilises.

Bitcoin is hovering near $84,000, up from its two-month low level of $82,000 seen on Friday, as markets reacted to President Donald Trump nominating Kevin Warsh as the next US Federal Reserve Chair.

In the past 24 hours, Bitcoin rose by 1.63%, while Ethereum fell by 0.86% to trade at the $2,687 level. In the same period, among major altcoins, BNB, Solana, Tron, Dogecoin and Hyperliquid rose by over 7%, while XRP and Cardano declined by 0.69% and 3.03%, respectively.

Also Read | Budget 2026: Mutual fund industry seeks debt indexation return, ELSS relief and MF pension schemes

The global crypto market capitalisation rose 0.89% to $2.83 trillion, according to .

Crypto TrackerTOP COINS (₹) Bitcoin7,650,060 (0.81%)BNB77,640 (0.13%)Tether92 (-0.26%)XRP158 (-1.81%)Ethereum245,625 (-2.23%)Nischal Shetty, Founder, WazirX, said markets reacted to uncertainty around upcoming interest rate decisions and the independence of the Fed. As a result, the US dollar strengthened slightly, while risk assets came under mild pressure.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »After a strong run-up this month, the crypto market is taking time to consolidate as the impact of macro developments settles at a calibrated pace, Shetty added.

Live Events

Over the past week, Bitcoin and Ethereum declined by 6.59% and 9.13%, respectively. Among major altcoins, BNB, XRP, Solana, Tron, Dogecoin and Cardano fell by over 13%, while Hyperliquid rose by 34.73%.

Also Read | INR Check: What history reveals about gold, silver and market crashes

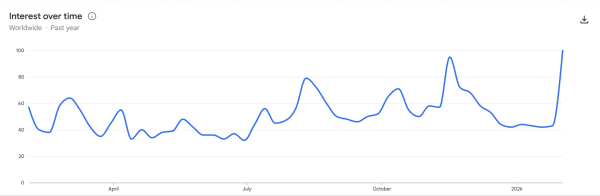

Riya Sehgal, Research Analyst, Delta Exchange, said over $2.7 billion has exited US spot Bitcoin ETFs since mid-January, raising concerns about weakening institutional demand. Gold’s recent rally and pullback diverted liquidity from digital assets, adding to risk-off pressure. Bitcoin options show the highest fear levels in a year, with a 17% delta skew as traders hedge downside risk.

Overall, the crypto market reflects caution after heavy liquidations, but reduced leverage and oversold positioning could support a short-term rebound if conditions stabilise, Sehgal added.