Bitcoin slips to 2-month low as Fed chair speculation hits risky assets

Synopsis

Bitcoin plunged to a two-month low Friday, losing a third of its value since October’s record highs. Speculation that a potential new Federal Reserve chair might reduce liquidity in financial markets is hitting cryptocurrencies. This uncertainty, coupled with fears around AI exuberance following a tech stock tremor, is driving the selloff, impacting other digital assets like Ether as well.

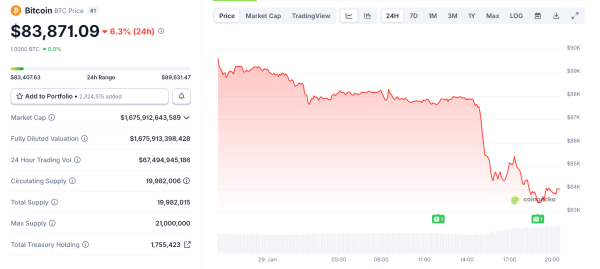

Bitcoin slumped to a two-month low on Friday as speculation the next chair of the U.S. Federal Reserve might tighten up on cash in the financial system hit cryptocurrencies and lifted the dollar.

Cryptos are having a rough time in what was once hoped to be a golden era of flows and friendly regulation under President Donald Trump, with the market-leading bitcoin losing a third of its value since striking record highs in October.

It traded 2.5% lower on Friday at $82,300, extending the previous session’s drop and heading towards a fourth straight month of losses, its longest losing streak for eight years.

Crypto TrackerTOP COINS (₹) Tether92 (-0.09%)BNB78,001 (-5.84%)Bitcoin7,613,018 (-6.11%)XRP162 (-6.23%)Ethereum252,357 (-7.16%) Selling gathered pace on intensifying speculation that former Federal Reserve Governor Kevin Warsh was about to be anointed as Trump’s pick to replace Fed Chair Jerome Powell.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details » Warsh has called for regime change at the central bank and wants, among other things, a smaller Fed balance sheet. Bitcoin and other cryptocurrencies have been regarded as beneficiaries of a large balance sheet, having tended to rally while the Fed greased money markets with liquidity – a support for speculative assets.

Live Events

“As you start to talk about pulling the rug out from underneath that … all the hedges against balance sheet expansion that people have been going for – gold, crypto, obviously bonds start to sell a little bit,” said Damien Boey, portfolio strategist at Wilson Asset Management in Sydney.

Ether also skidded to a two-month low and traded 2.9% lower at $2,735.48.

Cryptocurrencies have been struggling for direction since last year’s tumble and have been left behind by big rallies in gold and stocks that, on occasion, they had tracked.

Sean Dawson, head of research at Derive.xyz, a crypto options trading platform, said some correlation remains and that “fears around AI exuberance” were also a “big contributor” to Friday’s selloff.

A 10% drop in Microsoft stock after it reported a massive AI spend but only a modest revenue beat sent a tremor through global markets overnight.