Bitcoin could 6x following Gold’s RSI, according to macro expert

Bitcoin could 6x following Gold’s RSI, according to macro expert

![]() Cryptocurrency Jan 29, 2026 Share

Cryptocurrency Jan 29, 2026 Share

Gold’s momentum is reaching unprecedented levels, raising questions about what could come next not only for the precious metal but the crypto market as well, specifically Bitcoin (BTC).

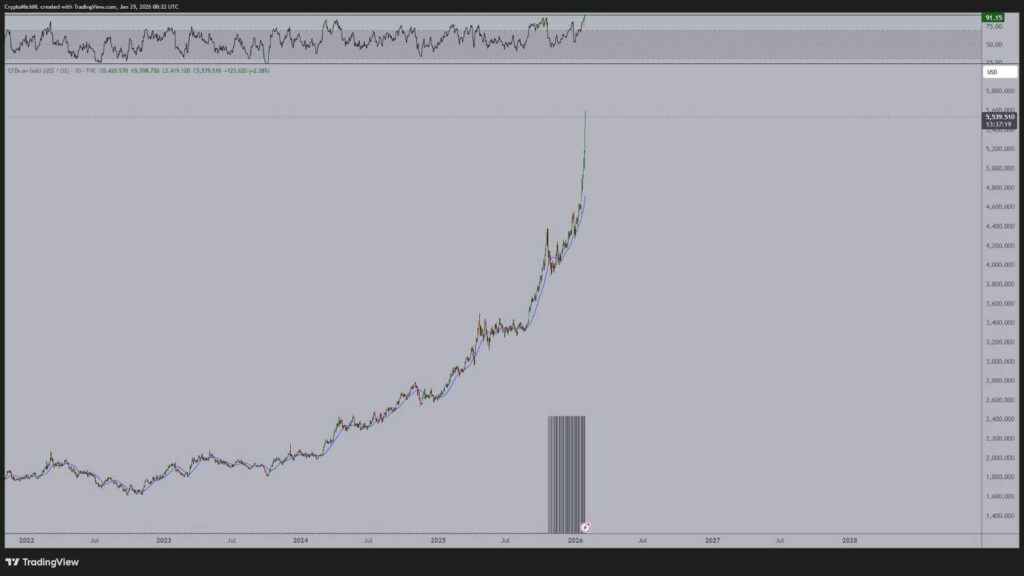

Namely, the gold price has now pushed its Relative Strength Index (RSI) above 91, a level that has been recorded only once before in history, December 1979, just before a prolonged consolidation phase.

Something similar also took place in August 2020, when gold again surged to record highs, just before consolidating and letting Bitcoin go on a nearly sixfold run over the subsequent cycle.

Understandably, the historical parallel has left investors wondering whether gold may once again be nearing a consolidation phase and potentially set the stage for renewed upside in its digital counterpart.

According to Michaël van de Poppe, macro market expert and crypto trading analyst, the current gold setup is historically extreme and could have implications for Bitcoin.

“Gold’s RSI above 91 has only happened once before — in 1979. It’s now higher than August 2020, which was followed by gold consolidating and Bitcoin rallying 5–6x,” said van de Poppe.

Gold price and RSI. Source: Michaël van de Poppe (@CryptoMichNL)

Gold price and RSI. Source: Michaël van de Poppe (@CryptoMichNL)

Gold rallies to record highs

The ongoing gold rally is largely the result of escalating geopolitical tensions and weakening of the U.S. dollar, with markets reacting to renewed threats of military action by United States President Donald Trump against Iran.

Indeed, bullion climbed above $5,500/oz on Thursday, up more than 20% since the start of the year. Last year, for comparison, the precious metal jumped 64% in total thanks to the new administration’s overhaul of global trade relationships and international institutions.

Gold’s strong performance has also been supported by waning confidence in other traditional safe havens, particularly government bonds, as investors grow increasingly uneasy about the scale of public debt across major developed economies, including the United States.

Meanwhile, the Federal Reserve left interest rates unchanged on Wednesday, January 28, keeping the benchmark policy rate in a 3.5% to 3.75% range. Speaking at a press conference following the decision, Fed Chair Jerome Powell said the central bank would consider cutting rates once inflation shows clearer signs of easing.

Bitcoin’s trajectory uncertain

As for crypto, Bitcoin’s trajectory remains unknown. The market is currently weighing weakening technical signals against the potential for renewed institutional demand.

Regulatory catalysts are thus in focus, as upcoming discussions around U.S. crypto legislation and the possible outline of U.S. Strategic Bitcoin Reserve could both unlock fresh institutional capital or result in more uncertainty.

Whale accumulation, however, provides support. Large holders have been buying en masse and tightening the liquid supply in the process. Historically, such activity has tended to precede periods of heightened volatility.

All in all, the market appears to be in a waiting phase, with investors closely watching for new policy developments that could tip the balance toward the next major move in a setup characterized by extreme gold momentum and changing macroeconomic conditions.

Featured image via Shutterstock