Bitcoin Faces Fresh Geopolitical Risk as Trump Threatens ‘Far Worse’ Military Action Against Iran

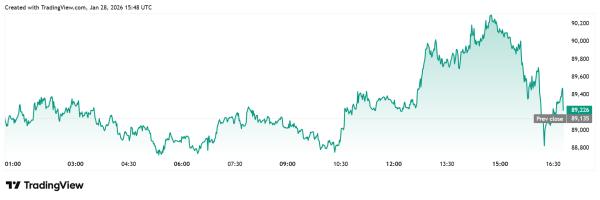

Bitcoin is once again facing new geopolitical risk following U.S. President Donald Trump’s threat against Iran. This development comes as the flagship cryptocurrency seeks to reclaim the psychological $90,000 level ahead of the Federal Reserve decision today.

Bitcoin At Risk as Trump Issues Warning To Iran

In a Truth Social post, the U.S. president warned that a massive Armada is heading to Iran, hinting at a potential strike against the country. Trump further remarked that the warship is a larger fleet than what they sent to Venezuela and that they are “ready, willing, and able to rapidly fulfill its mission, with speed, and violence, if necessary.”

Following his threat, Trump urged Iran to quickly negotiate a fair and equitable deal, one without nuclear weapons, and that is good for all parties. He added that time is of the essence, alluding to their previous reluctance to make a deal that led to Operation Midnight Hammer. “The next attack will be far worse! Don’t make that happen again,” he concluded.

The Bitcoin price fell below $90,000 following Trump’s threat against Iran. $BTC is also at risk of decline, especially considering how the leading crypto reacted when the U.S. struck Iran last year over its failure to make a deal regarding nuclear weapons. $BTC notably dropped below $99,000 back then, as the event triggered a risk-off sentiment.

Source: TradingView; Bitcoin Daily Chart

Source: TradingView; Bitcoin Daily Chart

Following Trump’s comments, the Iranian Mission to the U.N. stated that it was ready to engage in dialogue based on mutual respect and shared interests. However, it warned that the country will “defend itself and respond like never before” if pushed.

Last time the U.S. blundered into wars in Afghanistan and Iraq, it squandered over $7 trillion and lost more than 7,000 American lives.

Iran stands ready for dialogue based on mutual respect and interests—BUT IF PUSHED, IT WILL DEFEND ITSELF AND RESPOND LIKE NEVER BEFORE! pic.twitter.com/k3fVEv1rus

— I.R.IRAN Mission to UN, NY (@Iran_UN) January 28, 2026

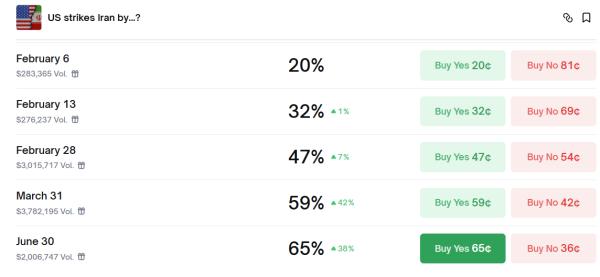

A Strike Against Iran Likely By June

Polymarket data shows that crypto traders are betting that the U.S. will strike Iran by June. There is currently a 65% chance of a strike by June 30, a move which would escalate geopolitical tensions and could send Bitcoin tumbling.

Source: Polymarket

Source: Polymarket

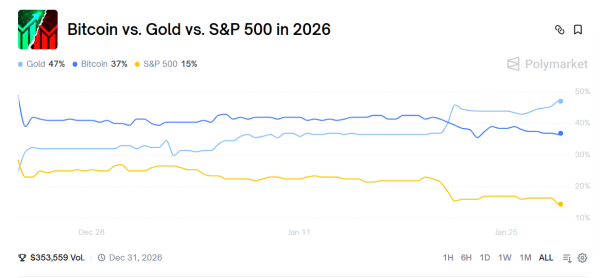

It is worth noting that amid these tensions, the gold price is rising, with the precious metal reaching a new all-time high (ATH) above $5,300. On the other hand, $BTC and the broader crypto market continue to trade sideways, having erased year-to-date (YTD) gains from the start of the year. Gold is also on course to outperform $BTC this year, as investors move to safe-haven assets.

Source: Polymarket

Source: Polymarket

Bearish sentiment in the crypto market also persists, with the Fed unlikely to lower interest rates until June. Polymarket data shows a 70% chance that the Fed will hold rates steady until the June FOMC meeting.

Recent Fed rate cuts have acted as a catalyst for higher prices in Bitcoin and the broader crypto market. $BTC rose to new all-time highs last year, just before the Fed lowered rates at the September and October meetings.