Crypto markets stabilise after volatile week; Bitcoin hovers near $88,300 ahead of Fed meet

Synopsis

The crypto market is stabilizing after a volatile week. Bitcoin is trading near $88,300, showing a rebound. Investors are cautious ahead of the US Federal Reserve’s policy meeting. Major altcoins are also seeing gains. Global crypto market capitalization has risen. The market is focused on big-tech earnings and the Fed’s update. This consolidation reflects waiting for clarity on monetary policy.

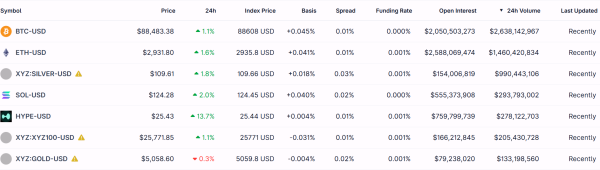

After a volatile week, the crypto market is stabilising, with Bitcoin rebounding from near $86,000 to around $88,300 as investors remain cautious ahead of the US Federal Reserve’s policy meeting.

The cryptocurrency was last trading near $88,366.

Over the past 24 hours, Bitcoin rose 0.87%, while Ethereum gained 2.59% to trade at $2,933. Among major altcoins, BNB, XRP, Solana, Dogecoin, Cardano and Hyperliquid advanced by up to 21%, while Tron slipped 0.43%.

Crypto TrackerTOP COINS (₹) Ethereum269,600 (2.64%)BNB81,127 (1.79%)XRP174 (1.4%)Bitcoin8,113,669 (1.08%)Tether92 (0.29%)Also Read | Should you stop SIPs during market corrections? Here’s what investors need to know

Riya Sehgal, Research Analyst at Delta Exchange, said Bitcoin rebounded from near $86,000 to trade around $88,500, while Ethereum remained steady near $2,930, supported by renewed optimism driven by on-chain accumulation and improving global liquidity signals. She added that despite near-term weakness, rising whale accumulation and the return of a global liquidity upcycle—last seen ahead of Ethereum’s 2021 rally—point to better medium-term prospects.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

According to , global crypto market capitalisation rose 1.1% to $2.99 trillion.

Akshat Siddhant, Lead Quant Analyst at Mudrex, noted that Bitcoin is stabilising after holding the $86,000 support level, indicating a potential near-term recovery. He added that fears of a possible US government shutdown had triggered a brief risk-off phase, but sentiment is improving as the dollar slips to a four-month low, driving flows back into assets such as Bitcoin.

Markets are now focused on key events this week, including big-tech earnings and the Fed’s policy update, Siddhant said.

In the past week, Ethereum and Bitcoin slipped 7.26% and 3.58%, respectively. In the same period, among the major altcoins, BNB, XRP, Solana Tron, Dogecoin, and Cardano went down over 7%, whereas Hyperliquid was up by 13.98%.

Nischal Shetty, Founder, Wazir X, said Bitcoin is holding near the $88,000 level. While it is down from recent highs but continues to find support. This sideways movement shows that markets are waiting for clarity rather than reacting sharply.

Currently, markets are pricing short-term uncertainty. Historically, during such phases, capital only moves to equities and crypto, once macro conditions stabilise,” Shetty said.

Also Read | 7 equity mutual funds lose over 12% in 3 months. Do you own any?

Market perspective

Vikram Subburaj, CEO, Giottus

Bitcoin traded on a cautious footing early Tuesday and extended a phase of consolidation as macro uncertainty continued to cap risk appetite. The world’s largest crypto asset hovered in the $87,000-$89,000 band during Asian hours, after failing to reclaim the psychological $90,000 mark overnight.

Markets broadly expect the Fed to hold rates steady and attention is focused on guidance around the timing of potential cuts later in 2026. Until greater clarity emerges on monetary policy, crypto markets appear set to remain in consolidation mode rather than attempt a decisive breakout.

CoinSwitch Markets Desk

BTC climbed toward $88K as selling pressure eased following a recent pullback, supported by short-term dip buying. Price action remains choppy, reflecting cautious positioning due to ongoing macro uncertainty.

Until BTC decisively breaks and sustains above the $89K level, upside moves are likely to remain corrective and range-bound rather than signaling the start of a sustained uptrend.