ChatGPT sets Bitcoin price for February 1, 2026

ChatGPT sets Bitcoin price for February 1, 2026

![]() Cryptocurrency Jan 23, 2026 Share

Cryptocurrency Jan 23, 2026 Share

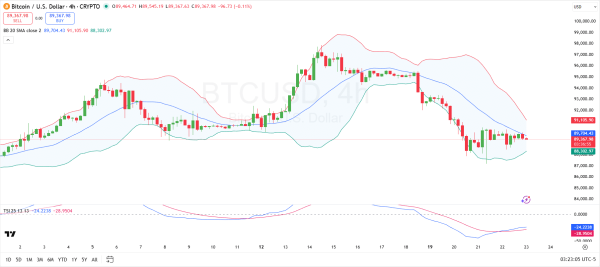

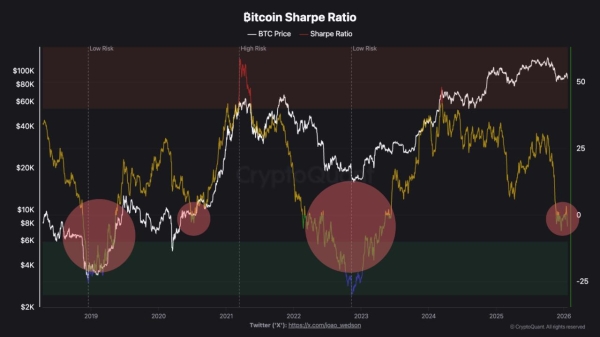

Bitcoin (BTC) is down more than 6% this week, as the flagship cryptocurrency faces institutional selling and weakening technicals. However, artificial intelligence (AI) models suggest a reversal might be coming by the end of the month for BTC.

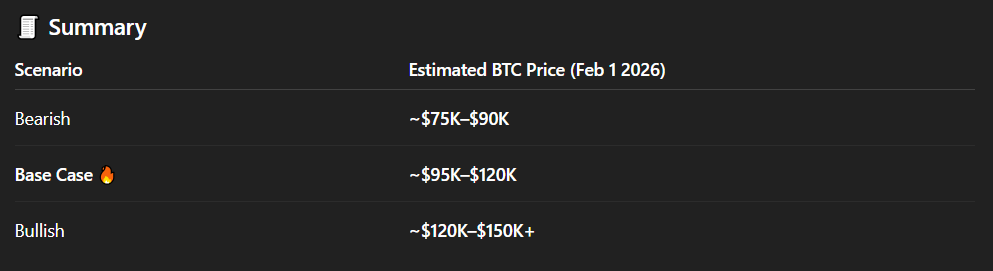

Specifically, OpenAI’s leading large language model, ChatGPT, has argued that a base-case scenario for February 1, which entails institutional buy-side interest, sees the Bitcoin price somewhere in the $95,000–$120,000 range.

This forecast implies as much as 35% upside from the current price of approximately $89,000 and holds that ‘digital gold’ could go back to where it was in early October 2025, when it hid a new all-time high above $126,000.

Weekly BTC price. Source: Finbold

Weekly BTC price. Source: Finbold

ChatGPT Bitcoin price prediction

Beyond the base-case scenario, the algorithm also noted some potential developments that could lead to more bullish and more bearish developments.

A more negative outcome, the chatbot argued, would see BTC prices dropping somewhere between $75,000 and $90,000. For this to happen, persistent risk aversion, slower institutional adoption, and broader market drawdowns would need to weigh heavily on the asset.

Conversely, improving macro conditions, including Fed easing, stronger Bitcoin ETF inflows, etc., could help the cryptocurrency push as high as $150,000. This, ChatGPT said, was the least likely scenario.

Bitcoin price forecast. Source: ChatGPT and Finbold

Bitcoin price forecast. Source: ChatGPT and Finbold

Short-term Bitcoin outlook

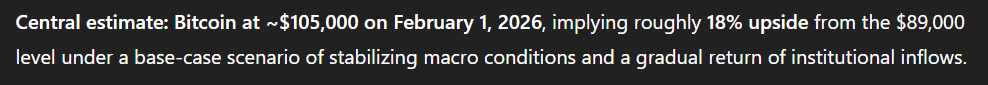

Asked to provide a more central estimate with a specific price point, ChatGPT suggested Bitcoin is up for a roughly 18% rally over the next week, with a price tag of $105,000 waiting on February 1.

Central BTC price estimate. Source: ChatGPT and Finbold

Central BTC price estimate. Source: ChatGPT and Finbold

This prediction assumes not only a more supportive geopolitical front but also a ‘gradual return to institutional inflows.’ The latter is especially noteworthy since, as mentioned, Bitcoin’s ongoing pullback reflects a convergence of institutional selling and a more bearish technical breakdown, with derivatives-related volatility to boot.

Short-term, the key question is whether BTC can reclaim and hold above $90,000 in the next few days or will the breakdown open the door to a deeper move toward a mid-$80,000 zone.

Featured image via Shutterstock