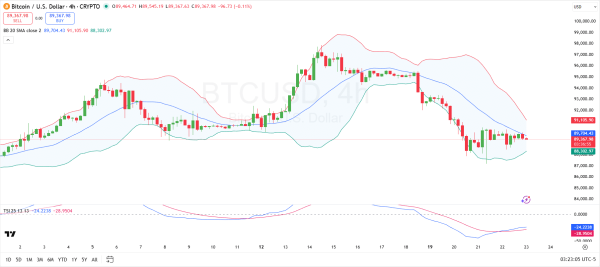

Bitcoin remains range-bound near $89,800 as investors look for cues

Synopsis

Bitcoin is trading in a narrow range near $89,800 as investors await fresh triggers. Analysts cite weak liquidity, ETF outflows and macro uncertainty, though price stability near $90,000 suggests underlying conviction remains intact despite broader market caution.

Bitcoin has remained range-bound and is trading near $89,800 as the market awaits a clear catalyst to set the next direction. The cryptocurrency was trading at the $89,873 level on Friday.

In the past 24 hours, Bitcoin and Ethereum were down by 0.08% and 1.51%, respectively. Among the major altcoins, BNB, XRP, Solana, Dogecoin and Cardano were down up to 2% in the same period, whereas Tron and Hyperliquid were up by 2.85% and 0.11%, respectively.

Also Read | Defence mutual funds surge up to 21% since last Budget. What should investors expect in 2026?

Akshat Siddhant, Lead Quant Analyst, Mudrex, said macroeconomic and geopolitical uncertainties are keeping activity subdued, though the underlying sentiment remains constructive.

Crypto TrackerTOP COINS (₹) Tether92 (0.0%)BNB81,477 (-0.19%)Bitcoin8,205,700 (-0.38%)Ethereum271,759 (-1.72%)XRP175 (-1.73%)

The CoinDCX Research Team said market participants appear uncertain about the upcoming price action, which has kept Bitcoin within a consolidated range.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

Ethereum and Bitcoin were down by 9.60% and 5.75%, respectively, last week. Among the major altcoins, BNB, XRP, Solana, Tron, Dogecoin, Cardano and Hyperliquid fell over 11% in the past week.

Vikram Subburaj, CEO, Giottus, said Bitcoin remained range-bound on January 23 as markets continued to digest thin liquidity and weak participation, with price action showing little urgency on either side, suggesting consolidation rather than a shift in conviction.

Subburaj further added that flows remain the main drag as US spot Bitcoin ETFs extended a run of net outflows during the January 22 to 23 window, pointing to institutional caution rather than panic selling.

Here is what other analysts say

CoinSwitch Markets Desk: While the move higher has stalled due to near-term supply pressure, driven by over 17,000 BTC flowing to exchanges on January 20 and 21, price holding near $90,000 suggests underlying conviction remains intact despite broader risk-off sentiment.

Also Read | Gold ETFs tumble up to 18%: Should MF investors hold, add, or exit?

Riya Sehgal, Research Analyst, Delta Exchange, said crypto markets remain fragile as Bitcoin and Ethereum consolidate following a sharp pullback, with price action reflecting caution amid shifting macro conditions.

Nischal Shetty, Founder, WazirX, said over the past 24 hours, market action shows participants to be thoughtful and selective. The price action suggests steady participation rather than aggressive speculation. This stability reflects growing maturity, with Bitcoin increasingly viewed as a long-term asset even as short-term traders remain selective.