If you invested $1,000 in Robert Kiyosaki’s gold, silver, and Bitcoin portfolio in 2026, here’s your return so far

If you invested $1,000 in Robert Kiyosaki’s gold, silver, and Bitcoin portfolio in 2026, here’s your return so far

![]() Cryptocurrency Jan 19, 2026 Share

Cryptocurrency Jan 19, 2026 Share

Despite years of gloomy forecasts, best-selling personal finance author and prominent ‘finfluencer’ Robert Kiyosaki’s favorite assets, gold, silver, and Bitcoin (BTC), are all up in early 2026, meaning a $1,000 investment at the start of the year would already be showing a double-digit gain.

To see how his strategy is holding up, we calculated the return on a simple $1,000 investment made on January 1, 2026.

The Robert Kiyosaki portfolio 2026 performance

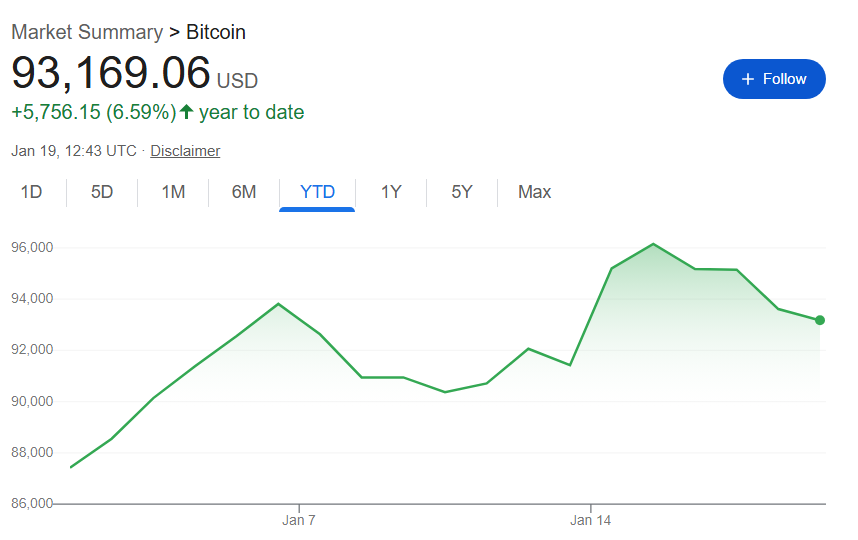

In the first 19 days of the year, Bitcoin rose 6.59% from $87,412 on New Year’s Day to $93,169 at press time. This means that a $1,000 investment made in BTC at the start of 2026 would have turned into $1,065 by January 19 – a limited but respectable profit of $65.90, considering less than three weeks elapsed so far.

BTC YTD price chart. Source: Google

BTC YTD price chart. Source: Google

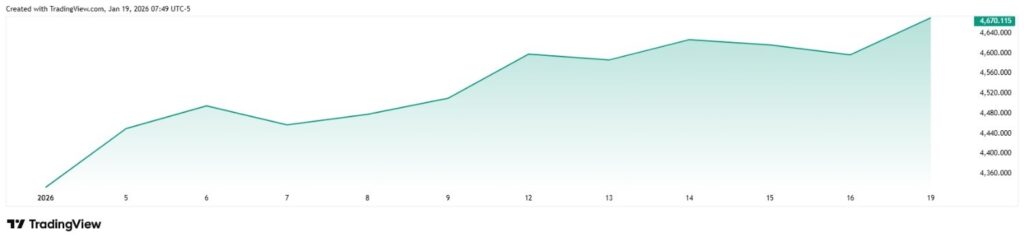

Gold, the world’s foremost ‘safe haven’ asset, has been even more impressive. The yellow metal is 7.94% up in the year-to-date (YTD) chart as it has risen from $4,332 to $4,669. Thus, $1,000 invested on January 1 would have turned into $1,079.

Gold YTD price chart. Source: TradingView

Gold YTD price chart. Source: TradingView

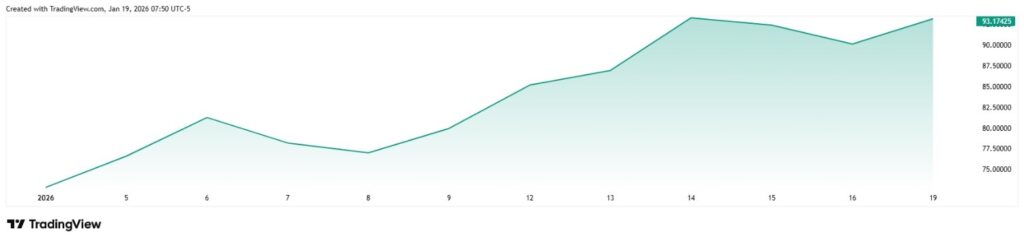

With a 27.39% rally in 2026, silver might be the most impressive among Robert Kiyosaki’s favoured assets. Indeed, $1,000 invested at $73 would have turned into $1,273 at the press time price of $93.

Silver YTD price chart. Source: TradingView

Silver YTD price chart. Source: TradingView

Lastly, had an investor chosen to create a $1,000 ‘Robert Kiyosaki portfolio,’ with an equal distribution among the three investments – so, $333 allocated to each of them – they’d have a total of $1,139 on January 19, for a total increase of 14%. Once again, a limited yet respectable profit in less than three weeks.