Cathie Wood calls bitcoin ‘good source of diversification’ for investors seeking higher returns

Bitcoin could play a growing role in institutional portfolios, according to Ark Invest CEO Cathie Wood, who described the asset as a valuable diversification tool in her 2026 market outlook.

In a wide-ranging note, Wood pointed to bitcoin’s low correlation with other major asset classes, including gold, equities and bonds, as a reason asset allocators should take it seriously.

“Bitcoin should be a good source of diversification for asset allocators looking for higher returns per unit of risk,” she wrote.

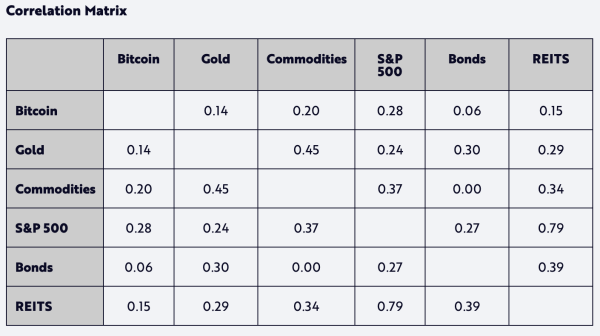

Wood argued that since 2020, bitcoin has shown weaker price correlations with stocks, bonds and even gold than those assets have with each other, according to Ark’s data. For example, bitcoin’s correlation with the S&P 500 was 0.28, compared to 0.79 for the S&P 500 versus real estate investment trusts, implying that bitcoin’s low correlation with other assets makes it a relatively better bet.

Asset correlations (Ark Invest)

Asset correlations (Ark Invest)

For large institutional investors managing risk-adjusted portfolios, this may open the door for bitcoin to serve as more than a speculative play.

However, Ark Invest CEO’s bullish comments came at a time when Jefferies strategist Christopher Wood did a complete 360 on his bitcoin recommendations for investors’ portfolios on Friday.

He removed his call for a 10% allocation into bitcoin and swapped it for gold instead. Jefferies Wood, who added bitcoin to his model portfolio in late 2020 and increased exposure to 10% in 2021, said advances in quantum computing could eventually weaken the Bitcoin blockchain’s security and, by extension, its appeal as a long-term store of value.

While Jefferies went more bearish on bitcoin’s exposure, Caitie Wood’s call aligns with what other major financial institutions have been saying recently. Morgan Stanley’s Global Investment Committee recommended “opportunistic” allocation of up to 4% in bitcoin, while Bank of America approved wealth advisors to recommend a similar approach.

CF Benchmarks also pointed to BTC as a portfolio staple, showing a conservative allocation could improve efficiency through better returns and greater diversification. Meanwhile, Brazil’s largest asset manager, Itaú Asset Management, recommended a small allocation to bitcoin as a hedge against FX and market shocks.

Read more: Bitcoin price may hit $300,000 to $1.5 million by 2030, Ark Invest Says