Bitcoin Price Forecast for Jan 15: Support Holds Firm as BTC Sees $655.36M in Futures Inflows

Bitcoin continues its bullish momentum with strong futures inflows, as support holds firm and traders eye further upside potential.

Notably, Bitcoin (BTC) extended its recent recovery on Thursday, climbing 1.9% over the past 24 hours, and is now trading at $96,517. The price fluctuated between $94,620 and $97,704 but is now trading near the mid-range.

Bitcoin’s surge aligns with broader market sentiment, which has been influenced by developments like the proposed U.S. bill aiming to create a regulatory framework for crypto. This bill has bolstered confidence among investors, contributing to Bitcoin’s price action.

In terms of market metrics, Bitcoin’s market cap stands at a staggering $1.93 trillion, up 1.76% today. The 24-hour performance shows consistent growth, with 6.4% gained in the last week and 10.2% in the past 14 days, indicating an ongoing bullish trend. Amid this performance, traders are looking for whether the momentum can hold, potentially leading to new all-time highs.

Can Bitcoin Momentum Hold?

On the technical side, Bitcoin continues its bullish momentum, with key indicators supporting further upside potential. The Parabolic SAR indicator sits below the price action at around $90,221, suggesting that Bitcoin remains firmly in an uptrend.

Bitcoin 1 Day Chart

Bitcoin 1 Day Chart

The dots beneath the price confirm that the trend structure is intact, with no immediate signs of reversal. As Bitcoin approaches resistance near $97,800, the Parabolic SAR continues to signal trend support, with a breakout above this level potentially opening room for further upside.

Additionally, the Standard Deviation rests at 2,807.06, reflecting surging market volatility. This elevated reading highlights increased price fluctuations and rising market uncertainty. As a result, Bitcoin could either extend its rally if momentum holds or face sharp corrective moves if volatility triggers liquidations.

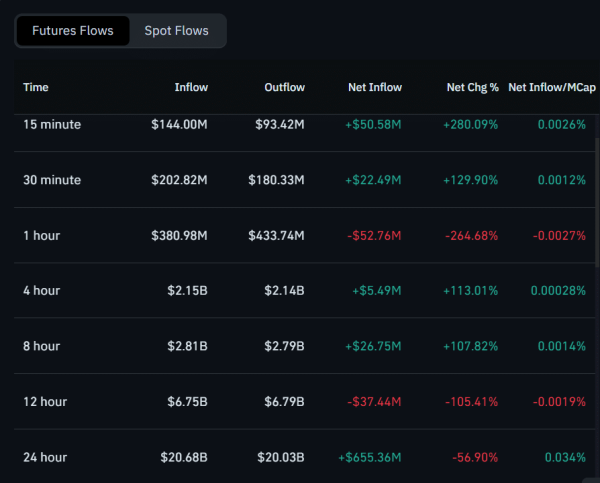

BTC Futures Flows

Meanwhile, the futures flow data shows active positioning with mixed short-term signals but a positive broader bias. The 30-minute window remained positive, posting $202.82M in inflows versus $180.33M in outflows, for a net inflow of $22.49M.

Bitcoin Futures Flows

Bitcoin Futures Flows

However, the 1-hour timeframe saw a reversal, with $380.98M in inflows and $433.74M in outflows, producing a net outflow of $52.76M.

On higher timeframes, flows stabilize again. The 4-hour window recorded $2.15B in inflows and $2.14B in outflows, leaving a net inflow of $5.49M, while the 8-hour period showed a $26.75M net inflow.

Over the past 12 hours, flows turned negative with a $37.44M net outflow, but the 24-hour data remains firmly positive, showing $20.68B in inflows versus $20.03B in outflows, resulting in a net inflow of $655.36M.