Bitcoin Price Fails to Maintain Its Early Week Uptrend: What Happens Next? Here Are the Expert Opinions

Bitcoin is completing the first full trading week of 2026 with a sideways movement. The largest cryptocurrency is holding steady around the $90,000 level, down approximately 2% since the start of the year.

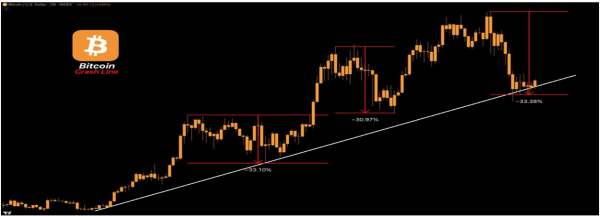

The price has failed to break above the $95,000 threshold, which has become a strong resistance level since the sharp sell-off in October.

Bitcoin, which showed some recovery at the beginning of the week with the New Year rally, lost momentum after peaking below $94,800 on Monday. At the time of writing, it is trading at $90,674.

Investors are acting cautiously due to the tariffs on the agenda in Washington, uncertainties surrounding the Fed chairmanship, and steps regarding cryptocurrency regulation. The US Supreme Court did not announce its expected decision on Friday regarding the legal status of the tariffs imposed by Donald Trump. This, along with ETF flows and geopolitical uncertainties, has contributed to Bitcoin remaining in “wait mode.”

Jake Ostrovskis, head of over-the-counter (OTC) trading at Wintermute, said, “Following a strong start to 2026, we’re seeing a classic post-rally consolidation.”

Better-than-expected economic data has dampened hopes for further interest rate cuts. This is limiting Bitcoin’s momentum toward its all-time high of over $126,000 seen in October.

CoinShares Head of Research James Butterfill commented, “Macro data is generally stronger than expected. This is somewhat reducing the likelihood of a rate cut in March, putting downward pressure on prices in the short term.”

Some market participants, however, find the current slowdown constructive. Brian Vieten, senior research analyst in digital assets and blockchain at Siebert Financial, said, “Bitcoin is consolidating around $90,000 after a prolonged sell-off driven by concerns about realizing tax losses and the possibility of MSCI delisting digital asset treasury companies. That risk has now dissipated, and the selling pressure has largely subsided.”

Index provider MSCI this week shelved its plan to remove digital asset treasury companies from its indices, arguing that they behave like mutual funds.

Despite short-term uncertainties, optimism remains for the long term. Butterfill stated that the $200,000 level is possible by the end of the year, while Ostrovskis said that a sustained break above $95,000 would re-trigger systematic buying and could push Bitcoin back into six-figure prices. He commented, “A sustained break above $95,000 could trigger a reflexive rise in the market.”

*This is not investment advice.