Bitcoin drops towards $90,000 as traders await US jobs data and Supreme Court ruling on global tariffs

Synopsis

Bitcoin slipped towards the $90,000 mark while Ethereum hovered near $3,150 as investors awaited key US jobs data and a Supreme Court ruling on global tariffs. Analysts see consolidation amid ETF flows, geopolitical uncertainty and technical resistance levels.

Bitcoin slipped towards $90,000 and Ethereum traded near $3,150 as traders await US jobs data and the Supreme Court ruling on global tariffs. The cryptocurrency was trading at $90,915, while Ethereum was trading at $3,150 on Thursday.

In the past 24 hours, Bitcoin and Ethereum were down by 1.82% and 3.23% respectively. Among major altcoins, XRP, BNB, Solana, Dogecoin, Cardano, and Hyperliquid edged down up to 4% in the past 24 hours, while Tron rose 1.12% during the same period.

Also Read | Gold vs Silver ETFs: Where should investors deploy funds amid US–Venezuela conflict?

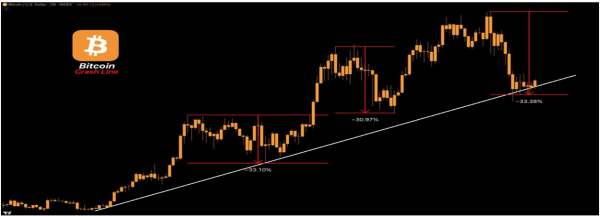

Riya Sehgal, Research Analyst at Delta Exchange, said that technically, Bitcoin remains below its 20 EMA near $92,000 and is testing support at $90,000. Ethereum is trading below its 20 EMA at $3,187, with key support at $3,080. Both assets need to reclaim short-term resistance to resume upward momentum.

Crypto TrackerTOP COINS (₹) Tether90 (-0.16%)BNB80,398 (-1.73%)Bitcoin8,174,269 (-1.94%)Ethereum283,296 (-3.21%)XRP194 (-4.23%)

Sehgal added that despite short-term weakness, steady ETF inflows and easing inflation continue to support the broader crypto outlook.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

The global crypto market capitalisation edged down 1.9% to $3.12 trillion, according to .

Over the past week, Bitcoin and Ethereum were up 3.98% and 6.07% respectively. Among major altcoins, XRP, BNB, Solana, Tron, Dogecoin, Cardano, and Hyperliquid gained up to 25% during the same period.

Akshat Siddhant, Lead Quant Analyst at Mudrex, said Bitcoin is holding firm above the $90,000 support zone, showing resilience despite short-term ETF driven selling. After recent inflows of $1.2 billion, Bitcoin ETFs saw a modest $243 million in outflows, but underlying demand remains strong.

He further said that accumulator addresses increased holdings to around 310,000 BTC this week from roughly 249,000, while exchange supply has dropped to nearly 13.7%, one of the lowest levels since 2018. For price action to turn bullish, Bitcoin needs sustained buying above $93,000, and US jobless claims data scheduled for today could act as a key catalyst.

Here is what other analysts say

CoinSwitch Markets Desk

Bitcoin attempted to breach the $94,000 mark but pulled back into the $91,000 to $92,000 zone. The market witnessed profit booking along with long liquidations, highlighting elevated leverage across positions. In the near term, price action is expected to remain volatile and range bound as participants wait for fresh catalysts.

Also Read | Why simplifying Rs 3 crore portfolio is crucial with retirement approaching? Expert answers

Vikram Subburaj, CEO, Giottus

Bitcoin has reclaimed the psychologically significant $90,000 level but has encountered resistance around the $94,000 to $95,000 range. Momentum cooled as participants adjusted positions rather than committing aggressively to fresh buying.

Market data indicate consolidation rather than trend reversal, with major support levels near $88,000 to $90,000 and resistance clusters at $94,000 to $95,000.

Nischal Shetty, Founder, WazirX

Over the past 24 hours, crypto markets have remained in a consolidation phase, with price action influenced primarily by short-term positioning and market structure rather than fresh macroeconomic catalysts.

Broader risk sentiment has been shaped by elevated geopolitical uncertainty, which has moderated risk appetite across global asset classes. In crypto markets, this has led to range-bound trading rather than sharp sell-offs, indicating a relatively balanced market state.

(Disclaimer: The recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of The Economic Times.)