Bitcoin hits seven-month low, tumbles below $82,000. What’s next for investors?

Synopsis

Bitcoin plunged to a seven-month low near $80,000, mirroring a broader market retreat from riskier assets due to stretched tech valuations and interest rate uncertainty. Analysts warn of steeper losses if the $82,000 support breaks, though some see signs of dip-buying. Ether also experienced significant declines.

Bitcoin dropped to a seven-month low, edging dangerously close to the $80,000 mark, a level below which analysts believe the cryptocurrency could face far steeper losses. The world’s largest digital asset fell to $80,553, while ether tumbled to a four-month low, as cryptocurrencies led a broader retreat from riskier assets amid mounting concerns over stretched tech valuations and renewed uncertainty around U.S. interest-rate cuts.

Often seen as a proxy for investor risk appetite, crypto’s sharp declines reflect the increasingly fragile mood across markets. High-flying AI stocks have stumbled, leading the Bitcoin to shed nearly 13% this week alone. The drop follows a powerful rally earlier in the year that lifted Bitcoin above $120,000 in October, buoyed by improving regulatory sentiment toward crypto globally.

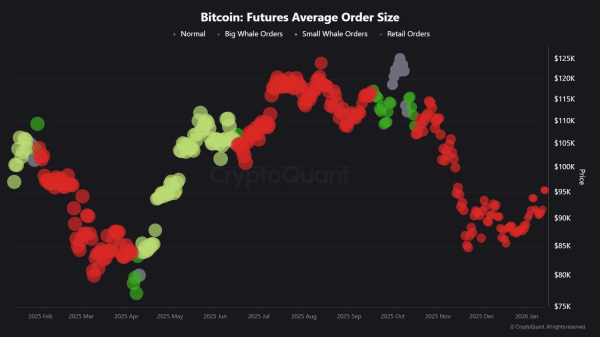

“Bitcoin’s break below $82,000 comes amid a broad market unwinding, with more than $2 billion in leveraged positions liquidated in 24 hours,” Riya Sehgal, Research Analyst at Delta Exchange, said that macro conditions have shifted rapidly.

Crypto TrackerTOP COINS (₹) Tether90 (1.14%)XRP175 (0.25%)Bitcoin7,574,203 (-0.02%)Ethereum247,287 (-0.08%)BNB74,424 (-1.54%)Sehgal, however, noted that despite selling pressure from large holders, steady accumulation around $85,000 shows dip-buyers are stepping in. “Bitcoin’s momentum reset is nearing exhaustion, a phase that has preceded sharp reversals in past cycles,” she said. Technically, the cryptocurrency is sitting on a critical support zone at $82,000; losing that level could open downside risk toward $78,000. On the flip side, reclaiming $90,000 would put a move toward $98,000 back on the table.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Ethereum remains under strain after slipping below $2,700. Immediate support is at $2,600, followed by $2,450. Experts say ETH needs to climb back above $2,800 to stabilize; if not, a fall toward $2,300 is possible, with broader trend indicators still leaning bearish.

Live Events

Across the crypto board, Sola dropped 5% at $125, while BNB slid over 4% to $820 levels. The two are down 12% each on a weekly basis. Bitcoin briefly touched $81,629 in London trading before recovering toward $84,166, but it remains down 23% for the month — its steepest monthly slide since the 2022 crypto meltdown.

Open interest in Bitcoin perpetual futures has fallen 35% from the October peak of $94 billion, signaling a sharp unwind of leveraged positions. Market maker Keyrock noted traders remain hesitant to re-enter the market “in size,” with activity now far below recent highs.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Source