Rich Dad Poor Dad author Robert Kiyosaki’s latest wealth move involves selling Bitcoin. What’s your ‘Get Rich’ plan?

Synopsis

Rich Dad Poor Dad author Robert Kiyosaki sold $2.25 million in Bitcoin, bought at $6,000 per coin, for approximately $90,000. He’s reinvesting this into two surgery centers and a billboard business, expecting significant monthly income. Kiyosaki views this as a strategic move to acquire income-generating assets with tax advantages, not an exit from Bitcoin.

![]()

Listen to this article in summarized format

Listen Loading…×× Subscribe to

Unlock AI Briefing and Premium Content

Subscribe Now

What’s Included

- Exclusive Stories

- Daily ePaper Access

- Smart Market Tools

- Curated Investment Ideas

- Ad-lite Experience

Subscription

Subscription

Robert Kiyosaki has never been shy about championing wealth-building paths, and his latest post is a fresh example of the Rich Dad Poor Dad author showcasing exactly how he puts his philosophy into practice.

In a detailed X (formerly Twitter) note, Kiyosaki revealed that he recently liquidated a significant Bitcoin position, $2.25 million worth, which he originally acquired at $6,000 a coin, for roughly $90,000. With that cash, Kiyosaki says he is now buying two surgery centers and investing in a billboard business.

According to him, the shift isn’t an exit from Bitcoin but another step in a decades-long strategy. The new investments, he estimates, will generate “approximately $27,500 a month income by next February… tax free.” That, he says, will sit on top of what he describes as years of existing cash-flow positive businesses, pushing his monthly cushion into “$100’s of thousands per month.”

Crypto TrackerTOP COINS (₹) Tether90 (1.14%)XRP175 (0.25%)Bitcoin7,574,203 (-0.02%)Ethereum247,287 (-0.08%)BNB74,424 (-1.54%)Kiyosaki frames the move as a play straight out of his own teachings: turning gains into durable assets with tax and debt advantages. “If you have read Rich Dad Poor Dad and played my Cash Flow boardgame,” he wrote, “you will recognize my latest Bitcoin acquisition of income generating real estate with tax and debt advantages being played out in real life.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Even as he redeploys the gains, he insists he remains optimistic about Bitcoin: “I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow.” A big proponent of the Bitcoing, he’s also previous critiqued market mammoths like Warren Buffet.

Live Events

In a previous post last week, he said “Warren Buffet is arguably the smartest and maybe the richest investor in the world. He trashes Bitcoin saying it is not investing…it is speculation… ie gambling. He is saying a blow off top will wipe out Bitcoiners. And from his worldly view he may be right. Yet WB sells stocks, bonds, and other Wall Street manufactured “assets.” Doesn’t WB know that stocks crash, real estate crashes, and US govt Bonds the “safest” investments in the world are at present being “dumped” by the Japanese and Chinese Central Banks”

True to form, Kiyosaki also uses the post to prod followers about their own approach to wealth. He contrasts his path with two names. “I am not saying my plan should be your plan. Warren Buffet would think my plan too slow and foolish. Warren has his plan… as does Donald Trump.”

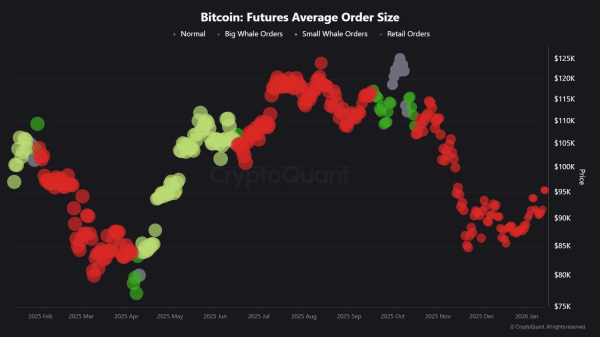

Kiyosaki’s Bitcoin cash-in comes amid growing doubt over the risk-sensitive cryptocurrency which slipped below $82,000 earlier today.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)