Bitcoin Loses ‘Digital Gold’ Label, Top Bloomberg Expert Proves

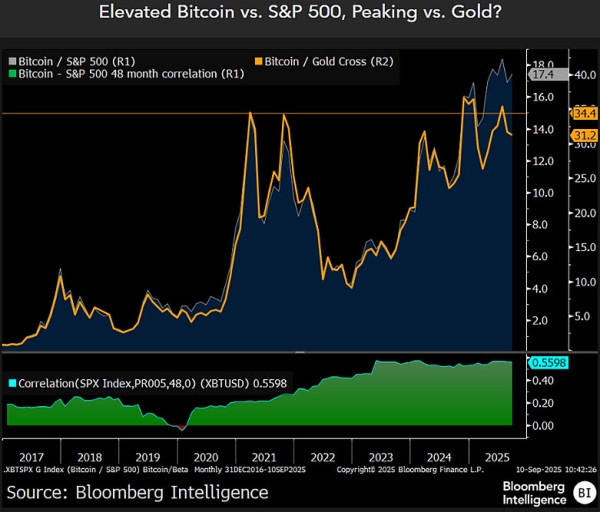

Bitcoin’s role in financial markets is changing, and there are some numbers that make this very clear. Michael McGlone, a Bloomberg Intelligence strategist, pointed out that as of Sept. 10, the 48-month correlation between Bitcoin and the S&P 500 reached 0.5598, its highest point on record.

To put it simply, the leading cryptocurrency is now more closely linked to equities than ever before. It is not really a store of value any more but rather a risky investment that is tied to the performance of stocks.

Back in 2017 and 2018, the correlation was well below 0.2, meaning that Bitcoin was doing its own thing with its own cycles, while stocks were marching to a different drum.l

That picture has changed a lot since late 2019, when the correlation started climbing steadily, first because of all the money from the pandemic and then because of the Federal Reserve’s tightening and easing policies.

The latest data shows that Bitcoin’s beta against the S&P has been consistently trading above 10, peaking near 17 this year. This means that for every percentage point move in stocks, Bitcoin has been swinging many multiples more.

No more “digital gold?”

As Bloomberg’s chart shows, Bitcoin’s performance against gold has crossed above 30 in 2025. In contrast, the classic safe haven has remained stable.

The numbers confirm what traders have long suspected: Bitcoin is no longer the “digital gold” it was marketed as a decade ago. It has evolved into a highly sensitive barometer of risk appetite.

Thus, investors, who expect Bitcoin to protect them when things go wrong, are about to be disappointed. If the reading is indeed close to 0.6, it shows that Bitcoin is a beta to the NASDAQ or Russell 2000, not gold.