Cryptocurrency market wipes out $130 billion in 24 hours

Cryptocurrency market wipes out $130 billion in 24 hours

![]() Cryptocurrency Aug 25, 2025 Share

Cryptocurrency Aug 25, 2025 Share

The cryptocurrency market faced heavy selling pressure in recent hours as traders reacted to large whale movements and rising outflows from spot exchange-traded funds (ETFs).

As of press time, the global crypto market capitalization stood at $3.88 trillion, down from $4.01 trillion just 24 hours earlier, a $130 billion loss.

Total global crypto market cap. Source: CoinMarketCap

Total global crypto market cap. Source: CoinMarketCap

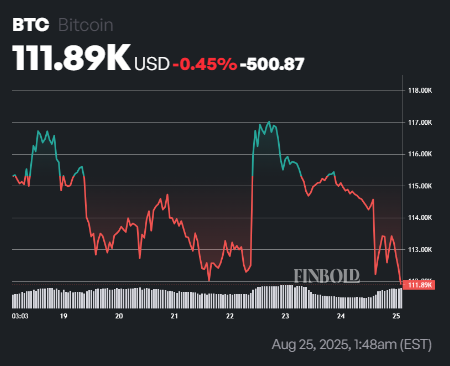

The sharp decline was led by Bitcoin (BTC), which slipped 2.61% in the past day to trade at $111,891 as of press time. On the weekly chart, the leading cryptocurrency has fallen 1.6%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Bitcoin whale transaction shed $4,000 from BTC

The sell-off, which fueled broader investor skepticism, was sparked by a notable whale transaction. In this case, an unidentified whale sold 24,000 BTC worth more than $2.7 billion on Sunday.

Consequently, this massive sale triggered an immediate $4,000 drop in Bitcoin’s price within minutes. Despite this move, the whale still holds 152,874 BTC valued at over $17 billion. If the wallet initiates additional sales, investors should brace for further market losses.

JUST IN: A Bitcoin whale sold 24,000 BTC worth over $2.7 billion, causing today’s -$4,000 crash in minutes.

They still hold 152,874 BTC worth more than $17 BILLION. 😳

h/t @SaniExp pic.twitter.com/m4aM9JwlAO

— Bitcoin Archive (@BTC_Archive) August 24, 2025

On the other hand, Ethereum (ETH) also joined the broader decline after hitting a new all-time high on Sunday. The second-largest cryptocurrency was trading at $4,659 at press time, reflecting a weekly loss of 2.89%.

The sell-off has also been driven by waning institutional interest, as highlighted by rising ETF outflows. To this end, between August 18 and August 22, Bitcoin spot ETFs recorded net outflows of $1.17 billion, led by BlackRock’s iShares Bitcoin Trust (IBIT), which saw $615 million in redemptions. Ethereum ETFs also reversed course, posting $238 million in net outflows and snapping a 14-week streak of inflows.

Bitcoin ETF flows. Source: Soso Value

Bitcoin ETF flows. Source: Soso Value

What next for Bitcoin price

With Bitcoin dictating the market’s direction, crypto trading expert Ali Martinez suggested the asset must hold the $112,000 support level to have any chance of reclaiming the $120,000 resistance.

Bitcoin $BTC holding $112,000 is all that's needed for a rebound back to $120,000! pic.twitter.com/xGC272pGUY

— Ali (@ali_charts) August 25, 2025

According to Martinez’s August 25 outlook, Bitcoin has bounced off this region multiple times over the past month, establishing $112,000 as a strong demand zone. However, a breakdown below this level could expose the cryptocurrency to further downside.

Overall, some analysts point to profit-taking, macroeconomic uncertainty, and failed breakout attempts by both Bitcoin and Ethereum as key drivers behind the current volatility.

Featured image via Shutterstock