Bitcoin tumbles nearly 8% in one week to $113K, Ethereum up by 3% in 1 day. Here is what experts say

Synopsis

Bitcoin rebounded to $113,643 after a recent high of $124,000, while Ethereum saw a 3% increase, trading at $4,289. Experts suggest the crypto market is bouncing back, with major tokens gaining over 4%. Investors are closely monitoring macroeconomic indicators and awaiting Jerome Powell’s speech for insights on potential rate cuts. The overall crypto market capitalization stands at $3.

Bitcoin was recorded at $113,643 on Thursday after hitting an all-time high of $124,000 just a week ago, while Ethereum rose nearly 3% in the last 24 hours to trade at $4,289. Analysts say the crypto market is attempting a bounce back, with major tokens gaining over 4% in a day.

“The crypto market is attempting a bounce back with major tokens gaining over 4% in a day. With Bitcoin currently trading near the immediate resistance of $114,600, the next significant hurdles lie at $116,700 and $118,200. A clean breakout above $118,200 would confirm that momentum is back in favor of the bulls. For now, investors are closely watching macroeconomic indicators such as unemployment data and PMI figures due later today, which could further influence market sentiment,” said Edul Patel, Co-founder and CEO of Mudrex.

Also Read | Swiggy, HDFC Bank, Eternal among stocks bought & sold by SBI Mutual Fund in July

At 10:48 AM IST, Bitcoin was trading at $113,775, up marginally by 0.22% over the past 24 hours and down nearly 8% over the past week. Ethereum, on the other hand, was trading at $4,299, up 3.36% in the past 24 hours but down 9.41% over the last seven days.

Crypto TrackerTOP COINS (₹) BNB75,207 (3.36%)Solana16,249 (3.23%)Ethereum374,385 (2.83%)XRP253 (0.57%)Bitcoin9,894,522 (0.0%)

According to data, the crypto sector’s overall market capitalisation stood at around $3.87 trillion on Thursday.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

Another expert said Bitcoin staged a modest recovery to $114,000 today, with altcoins rallying on renewed confidence.

“Historically, flush-outs either accelerate corrections or act as springboards for recovery, depending on how quickly supply is absorbed. Liquidity maps show the heaviest clusters around $112,000 and $120,000, levels that have repeatedly acted as magnets for price,” said Vikram Subburaj, CEO of Giottus.com.

“The market now looks forward to Jerome Powell’s speech tomorrow, with traders banking on 90% odds of a September rate cut. Should the US Fed validate that expectation, macro tailwinds could steady the ship. Altcoins have gained momentum, with Ethereum, BNB, Solana and Cardano all registering 4% gains. Meanwhile, the Crypto Fear and Greed Index has bounced back to the Neutral zone, after being in fear yesterday,” Subburaj added.

Analysts’ view

Sathvik Vishwanath, Co-Founder & CEO, Unocoin

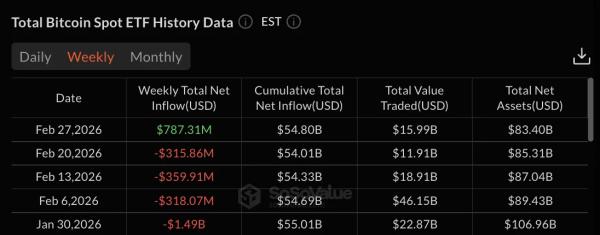

Bitcoin rebounded to $114,325 after dipping to $112,732, signaling that dip-buying demand remains resilient even as institutional flows weaken. Spot Bitcoin ETFs saw over $520 million in outflows on Tuesday, highlighting cautious sentiment ahead of the Federal Reserve’s FOMC minutes. Last week’s hotter-than-expected PPI data hinted at building inflationary pressure, weighing on risk assets. The rebound suggests short-term support near $112.7K remains intact, but volatility looms. A hawkish Fed tone could drag BTC back toward $112K, while dovish hints may spark momentum toward the $115.8K–$116.2K resistance zone, setting the stage for Bitcoin’s next decisive move.

Also Read | HDFC Bank, Jio Financial Services among top stocks bought and sold by Quant Mutual Fund in July

CoinSwitch Markets Desk

BTC rebounded to $114,700 from an intraday low near $112,400 after Federal Reserve minutes highlighted persistent inflation concerns and tariff-driven risks, keeping the tone slightly hawkish. Attention now shifts to Powell’s Jackson Hole speech on Friday, where traders will look for clearer signals on the likelihood of a September rate cut.

Meanwhile, BTC ETFs saw an outflow of $95.9 million. ETH rose 3.8% in the past 24 hours to trade near $4,300, while OKB extended its rally with a sharp 53% gain. In addition, Wyoming Senator Cynthia Lummis stated that the long-awaited U.S. market structure bill could reach President Trump’s desk by year-end, paving the way for implementation in 2026.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)