Machine learning algorithm predicts XRP price for March 1, 2026

Machine learning algorithm predicts XRP price for March 1, 2026

![]() Cryptocurrency Feb 18, 2026 Share

Cryptocurrency Feb 18, 2026 Share

XRP is riding a wave of renewed altcoin momentum on Wednesday, February 18, as capital rotates away from Bitcoin (BTC) and the broader market indicators suggest risk appetite is shifting.

Indeed, the Altcoin Season Index has jumped 8.82% over the past 24 hours and surged 32.14% in the last week, signaling a meaningful rotation into alternative digital currencies.

Over the same seven-day period, XRP has gained 7%, outperforming Bitcoin, which has risen 1%. As a result, Finbold’s machine learning algorithm suggests further upside potential for the token as we head toward March.

AI XRP price prediction

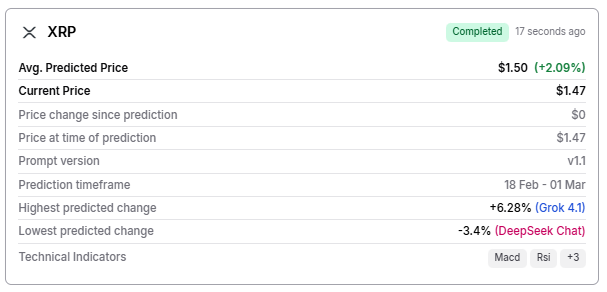

Finbold’s AI-driven price prediction tool, which blends inputs from ChatGPT, Grok, and DeepSeek, projects an average XRP price of $1.50 for March 1, 2026. The forecasted price implies a 2.09% upside from the current price of $1.47.

AI XRP price prediction. Source: Finbold

AI XRP price prediction. Source: Finbold

It is noteworthy, however, that not all three language learning models used in the calculation were equally optimistic. In fact, DeepSeek was bearish, projecting an XRP price of $1.42, which implies a 3.4% decline

ChatGPT and Grok were bullish, the former projecting a 3.4% rally and a $1.52 XRP price target, and the latter suggesting it could go up 6.28%, eventually trading at $1.56.

The Economics of the Global Online Gambling Business – How Big is it Really?

The global online gambling business is huge. Estimates placed the 2025 market at being worth around $78 billion a year, … Continue reading

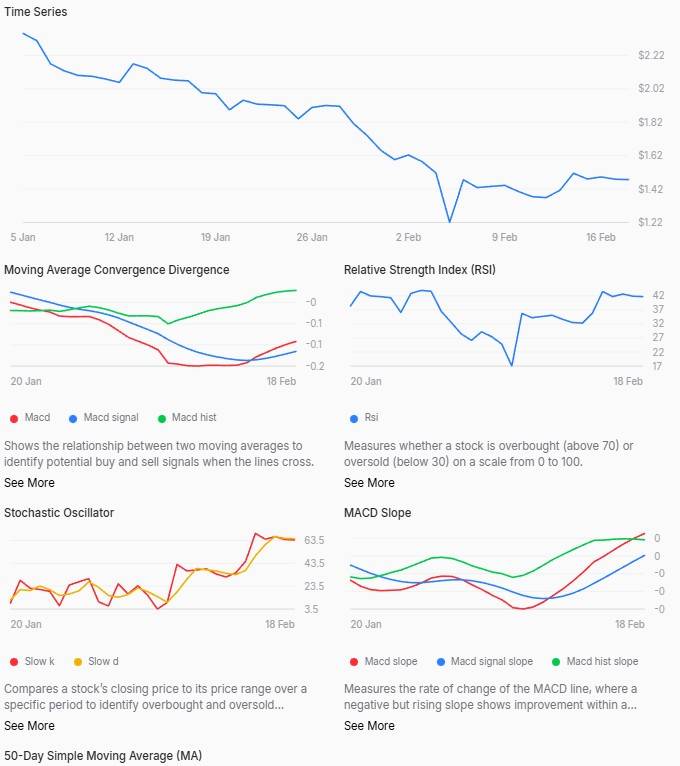

Featured Sponsored Feb 16, 2026  XRP technical analysis. Source: Finbold

XRP technical analysis. Source: Finbold

XRP price outlook

XRP’s trajectory seems positive from a technical point of view. Namely, the asset is trading above its seven-day Simple Moving Average (SMA) at $1.44 and its Exponential Moving Average (EMA) at $1.46, indicating short-term strength. Meanwhile, the MACD histogram has also turned positive, pointing to building bullish momentum.

The Relative Strength Index (RSI) sits at 42, leaving room for additional upside as the reading is not yet in the overbought territory. This supports the view that XRP’s rally is constructive.

As for the key levels to watch, a sustained move above the 50% Fibonacci retracement level at $1.58 would strengthen the case for a broader recovery. On the downside, holding the 61.8% retracement support at $1.47 is critical.

Featured image via Shutterstock