Bitcoin traders warn the $60,000 mark is a liquidation trigger

Synopsis

Bitcoin faces a critical juncture around the $60,000 mark. A break below this level could ignite significant market volatility. Options contracts and Bitcoin-backed loans are positioned to amplify downward pressure. Analysts warn of potential forced selling and cascading liquidations. This scenario could lead to a sharp price correction. Investors are closely watching this key price point for future movements.

As Bitcoin struggles to climb out of its current funk, several indicators suggest any breach of the $60,000 level would unleash a fresh bout of extreme turbulence.

The biggest cluster of bets in Bitcoin’s options market are contracts that pay off if the price falls below $60,000, according to data from Deribit. Just below that level is the token’s 200-week moving average — currently at just above $58,000 — seen by some technical analysts as a crucial support.

Many Bitcoin-backed loans are structured so that if the price falls toward that level, lenders automatically sell the collateral to cover losses, according to Maxime Seiler, chief executive of digital-asset trading firm STS Digital. That forced selling would push prices lower, triggering a cascade of leverage unwinding.

Crypto TrackerTOP COINS (₹) Ethereum185,893 (5.18%)XRP128 (3.73%)Bitcoin6,239,920 (3.61%)BNB55,837 (1.38%)Tether91 (-0.06%)Bitcoin briefly flirted with $60,000 on Feb. 6 before staging a modest recovery.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »“$60,000 is the key level to watch,” said Seiler. “A break under $60,000 could trigger forced deleveraging and hedging flows, creating a cascade effect. In that scenario, volatility would likely rise sharply as liquidations accelerate and traders rush to protect downside exposure.”

Live Events

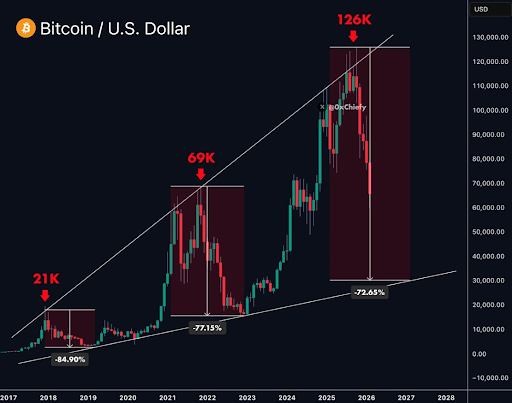

Bitcoin was trading around $67,000 in New York on Friday, down roughly 47% from its October peak. The reversal began late last year, when more than $19 billion in bullish bets were wiped out in a violent unwind that ended a powerful rally. Prices have struggled to regain footing since. In early February, selling intensified again, erasing all gains made since the re-election of pro-crypto US President Donald Trump.

There’s no shortage of bearish scenarios bedeviling crypto sentiment right now. Michael Burry, who rose to prominence for his wager against the US housing market ahead of the 2008 financial crisis, recently warned that Bitcoin’s plunge could deepen into a self-reinforcing “death spiral.” Standard Chartered this week cut its end-2026 price forecast to $100,000, down two-thirds from just two months ago.

StanChart analysts led by Geoffrey Kendrick said the original cryptocurrency could crash to $50,000 before stabilizing. That’s also the level with the second-highest level of open interest for put options, according to Deribit.

‘Everyone Is Bearish’

“Everyone we speak to is bearish in the “near term” (however they define it), so that says a lot about sentiment and positioning already,” said Augustine Fan, partner at Hong Kong-based crypto options platform SignalPlus.

A put option contract gives the holder the right, but not the obligation, to sell a specified asset at a predetermined price on or before a set expiration date. If Bitcoin falls toward or below $60,000, traders who sold those puts may hedge their exposure by selling Bitcoin or futures, which can add further downward pressure.

Open interest in $60,000 puts stands at $1.24 billion, Deribit data shows.

The crypto ecosystem’s leverage is fragmented and largely offshore, making any specific liquidation trigger hard to pinpoint. Still, market participants point to certain collateral bands as potential fault lines.

Seiler and IG Australia analyst Tony Sycamore are among those pointing to Bitcoin’s 200-week moving average as a key level of support — one which if broken could trigger a correction of almost another 20% according to Sycamore.

“A sustained break below the critical $60,000/$58,000 zone would likely open the door to a deeper pullback towards the next support level in the high $40,000s,” Sycamore said in a note on Friday.

Elsewhere in the market, Coinbase Global Inc. shares jumped in early trading as investors looked past the exchange’s fourth-quarter revenue miss as Bitcoin edged higher. Even after the bounce, the stock remains down roughly 50% over the past 12 months.