E-Estate Group Inc. tokenizes $100M in real estate as tokenization market heats up

E-Estate Group Inc. tokenizes $100M in real estate as tokenization market heats up

![]() Finance Feb 12, 2026 Share

Finance Feb 12, 2026 Share

E-Estate Group Inc. has announced that it has tokenized more than $100 million worth of premium property assets, marking an early milestone for the digital real estate platform as the broader tokenization market continues to gain momentum.

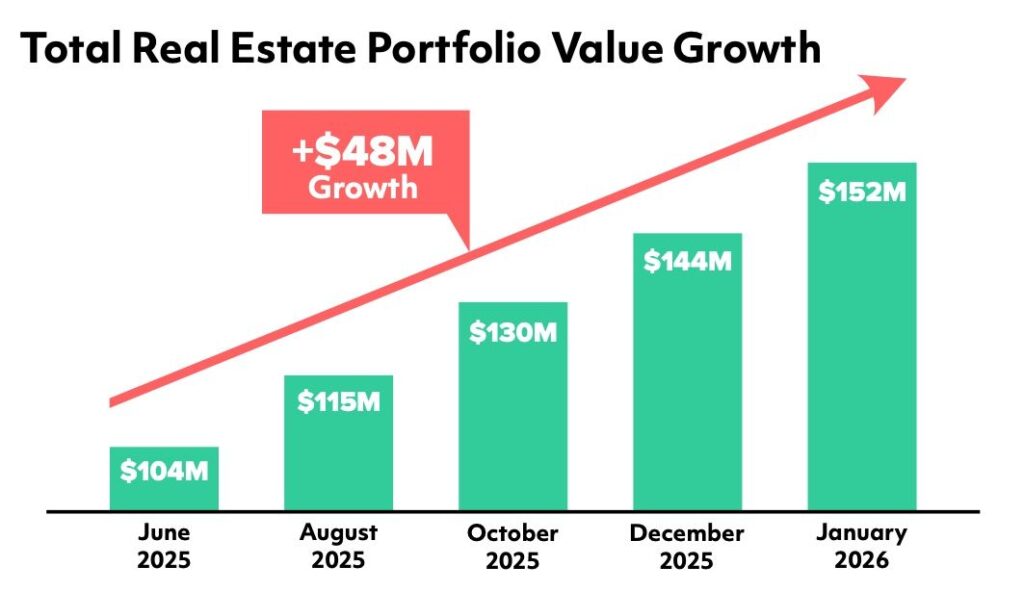

E-Estate’s 2025 annual report puts the platform’s tokenized real estate portfolio value at $104.62 million by year-end, spanning 11 tokenized property projects across multiple jurisdictions. The company also reported 2,039,787 EST tokens sold out of 10,462,000 issued, indicating roughly 19.5% distribution across the active portfolio.

Beyond the year-end snapshot, E-Estate’s report states the portfolio’s “actual value” stood at $152.32 million as of January 1, 2026, up from $104.62 million, with the change attributed to real asset appreciation and development-stage progress, particularly in Dubai-linked projects.

Real estate portfolio value growth. Source: E-Estate Group Inc

Real estate portfolio value growth. Source: E-Estate Group Inc

Tokenization strategy and early expansion

The firm was officially registered in Panama in November 2024 and later secured an international Legal Entity Identifier (LEI), positioning itself within recognized compliance frameworks. It also confirmed that its native Estate Token (EST) has been verified on the Binance Smart Chain, aligning the platform with established blockchain infrastructure.

E-Estate says its model focuses on fractional ownership, allowing investors to gain exposure to traditionally illiquid real estate assets through blockchain-based token issuance. By converting property value into digital tokens, the platform aims to streamline cross-border access, improve liquidity, and lower capital barriers that have historically limited participation in premium real estate markets.

The $100 million figure reflects the cumulative value of tokenized properties onboarded to date, according to the company’s disclosures.

Broader roadmap through 2034

Beyond its initial portfolio, E-Estate’s roadmap outlines plans for global expansion, additional asset categories, and deeper institutional integration over the coming years.

Crypto Casino Breaks Down How Slot Games Really Work as Online Play Continues to Grow

Slots remain the most widely played games in online casinos. Their simple mechanics, fast-paced gameplay, and wide variety of themes … Continue reading

Featured Sponsored Feb 11, 2026

In 2026, the company intends to host a Miami Summit aimed at attracting investors and agents from over 30 countries, while also expanding into new property classes including apartments and villas. Longer-term goals include quarterly financial reporting, expansion into the U.S. and European regulatory jurisdictions, and the potential issuance of corporate shares under a hybrid equity-token structure.

The roadmap also references preparations for a future listing on major stock exchanges, including Nasdaq and European markets, though no timeline has been formally confirmed.

Tokenization market gains traction

E-Estate’s announcement comes amid growing interest in real-world asset (RWA) tokenization, a sector that seeks to bring traditional financial and physical assets onto blockchain networks.

Industry observers have noted increasing institutional experimentation with tokenized bonds, funds, and real estate, driven by the promise of improved transparency, programmability, and settlement efficiency. Real estate, in particular, has emerged as one of the most discussed use cases due to its high capital requirements and historically low liquidity.

While the sector remains in its early stages, platforms such as E-Estate are positioning themselves to capture demand from both retail and cross-border investors seeking fractional exposure to global property markets.