Bitcoin Price Plummets on Bithumb after Staff Error Transfers 2,000 $BTC

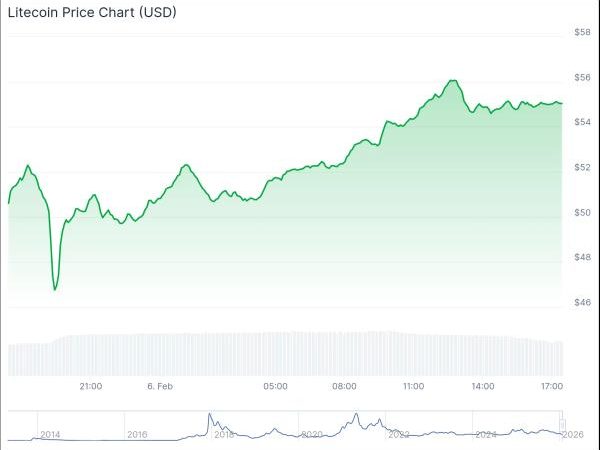

Bitcoin ($BTC) has recently gone through a sudden shift on Bithumb, a well-known South Korean crypto exchange. In this respect, the $BTC/KRW trading abruptly plummeted over 10% below the worldwide averages. As per the data from Lookonchain, a staff error, including the transfer of 2,000 $BTC, amid an airdrop campaign, led to this drastic development. After the respective move, several recipients rapidly traded the assets they received.

Bitcoin on #Bithumb suddenly dropped, trading over 10% below other markets.

Reports say a staff mistake during an airdrop sent 2,000 $BTC($133M) instead of a small KRW reward.

Some users sold it right away, causing the price to drop fast. pic.twitter.com/X8Zjaq86Tq

— Lookonchain (@lookonchain) February 6, 2026

Bithumb’s Mistaken 2K $BTC Distribution Ignites 10% Price Plunge

Based on the market data, the erratic transfer of 2,000 $BTC by Bithumb staff has paved the way for a 10% slump in Bitcoin’s price on the crypto exchange. As a result of that mistaken transfer, some recipients swiftly sold the assets they obtained. Due to this, the $BTC/KRW pair shed 10% on Bithumb in comparison with the worldwide averages. This mistake occurred amid the airdrop campaign of Bithumb.

Specifically, the crypto exchange was to distribute a small amount of Korean Won (KRW) as a reward for the recipients. Nonetheless, by mistake, they sent up to 2,000 $BTC to the consumers. The figure accounts for a stunning $133M when it comes to value. Thus, with many recipients selling the assets immediately, the $BTC/KRW pair slumped significantly.

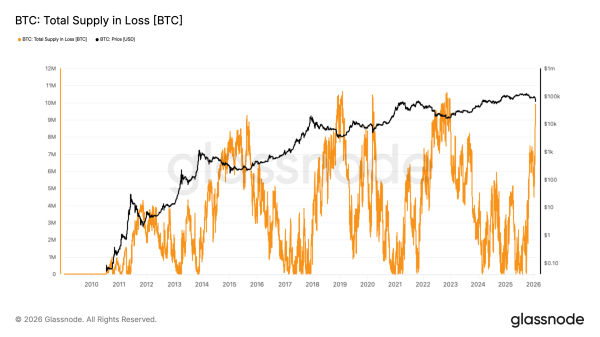

Traders Engage in Rapid Sell-Off Activity to Exploit Price Gap

According to Lookonchain, the market statistics present a massive selling pressure on the $BTC/KRW pair on Bithumb at the time. However, the discrepancy between the Bithumb-based price and the price on the other crypto exchanges paved the way for notable arbitrage opportunities. Even then, the liquidity constraints posed limits to traders, keeping them from completely exploiting the gap.