Bitcoin Price Dips To $60,000, Erasing Trump Election Gains

Story Highlights

-

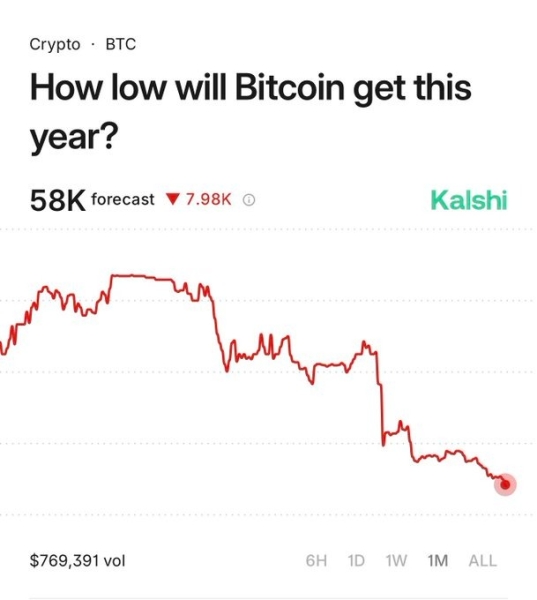

Bitcoin crashed to $60,000 after a sharp 15% drop erased post-election rally gains completely.

-

Miner selling pressure increased as average Bitcoin production cost rose above $87,000, forcing forced liquidations.

-

More than $2.6 billion leveraged positions liquidated, with long traders taking majority losses during sudden crash.

On February 6, the crypto market saw a sharp crash as Bitcoin plunged nearly 15%, wiping out around $350 billion in total market value in a single day. Bitcoin’s price fell to $60,030, erasing gains made since its October peak near $126,000.

This drop also wiped out the entire “Trump bump” rally from November 2024, as selling pressure increased from miners, profit-taking, deleveraging, and global market fears.

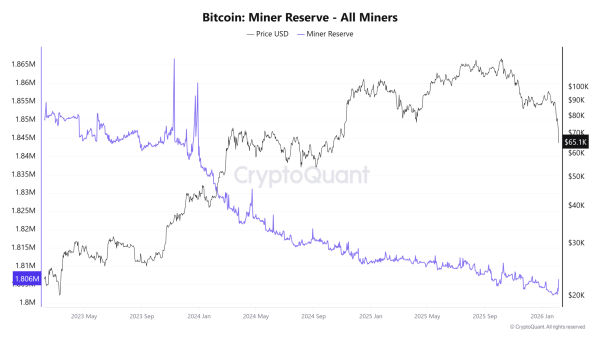

Bitcoin Price Drop Linked to Miner Selling Pressure

One of the biggest pressures is coming from Bitcoin miners. Data shows that the average cost to mine one Bitcoin has now risen above $87,000. With Bitcoin currently trading near $65,000, many miners are operating at a loss. To cover expenses, they are being forced to sell their holdings.

Bitcoin miner Reserves have fallen consistently over the past months and now stand near 1.806 million $BTC. This indicates that miners are selling more coins than they are keeping, adding to market supply.

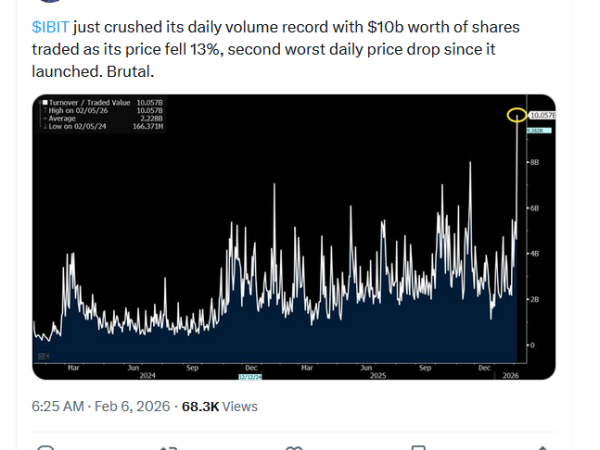

Bitcoin ETFs Record Heavy Outflows

At the same time, institutional demand has weakened sharply. Bitcoin exchange-traded funds (ETFs) saw heavy outflows again. On February 5, spot Bitcoin ETFs recorded $258.8 million in net withdrawals.

Although this was lower than the $544.9 million outflow seen a day earlier, the total outflows for the week have already crossed $1.07 billion.

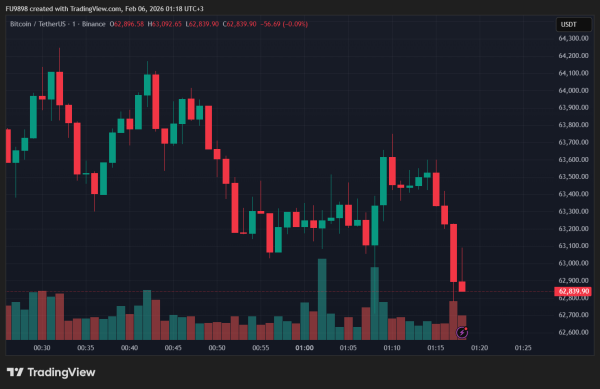

Liquidations Add More Pressure on $BTC Price

Liquidations also played a major role in pushing prices lower. In just 24 hours, more than $2.65 billion worth of leveraged crypto positions were wiped out. Around 82% of these liquidations came from long traders who were betting on higher prices.

The single largest liquidation happened on Binance, where a BTCUSDT position worth $12 million was forcibly closed.

Michael Saylor’s Strategy In Big Losses

Even major corporate Bitcoin holders felt the pain. Michael Saylor’s Strategy reported an unrealized loss of about $9 billion, equal to 16% of its massive Bitcoin holdings. Despite this, Saylor urged investors to stay calm and “HODL.”